Home •AMLTrack

AML Software Solutions for Compliance & Risk Screening

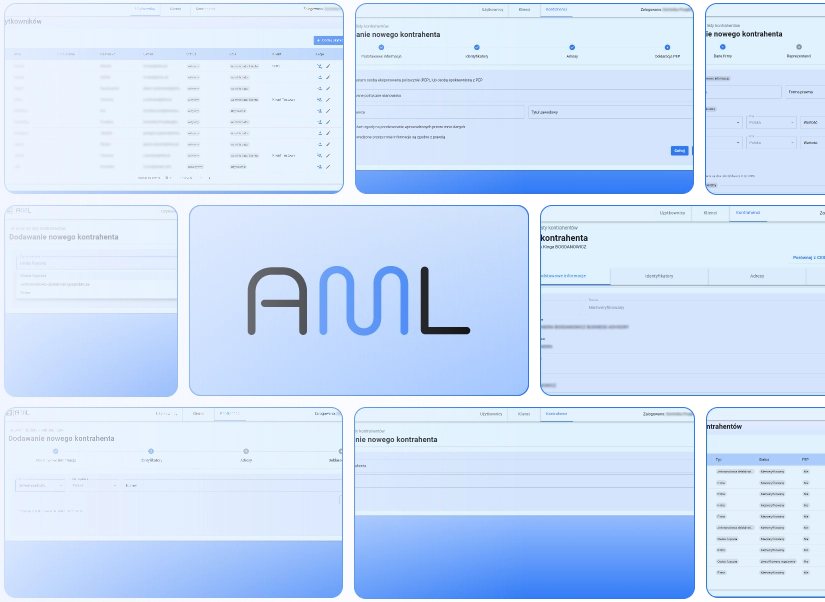

AML Track is an AML (Anti Money Laundering) Software, comprehensive solution that automates customer verification in line with AML requirements. The system screens counterparties against sanction lists (PL, EU, UK, and others), generates reports, and enables quick data comparison, such as addresses or document numbers.

Automatic verification of customers and sanction lists

AML Track developed by the software house TTMS together with the law firm Sawaryn & Partners, is a comprehensive IT platform designed to automate processes related to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF).

By leveraging cutting-edge technologies – including advanced data analytics, artificial intelligence (AI), and encrypted API communication – it provides instant verification of customers and sanction lists, eliminating the need for manual searches across multiple registries.

Our implementation approach is distinguished by close cooperation with the client from day one of the project: from needs analysis, through tailored platform configuration, to full user training and ongoing technical support.

What makes our AML system unique is its exceptionally fast and seamless integration with both national and international sanction databases. As a result, compliance gaps are eliminated while false positives are minimized.

System functionalities

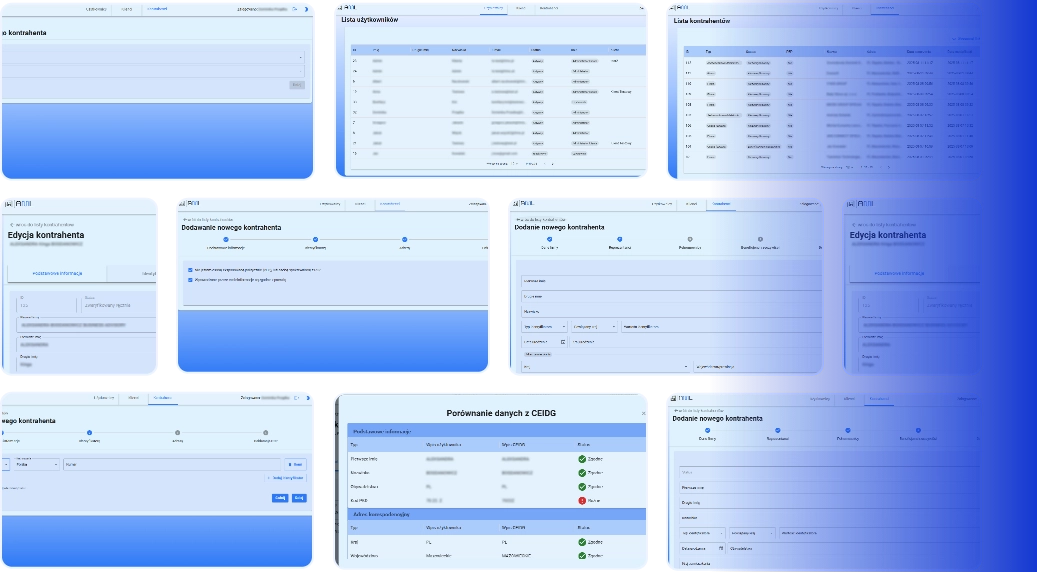

Seamless guidance through the KYC (Know Your Customer) procedure

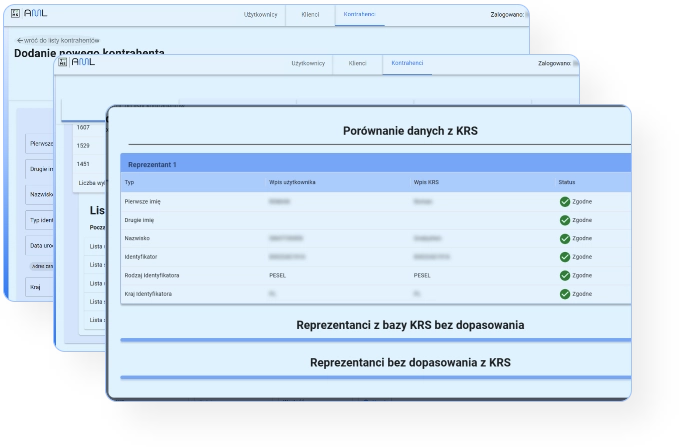

Automated data retrieval from CEIDG, KRS, and CRBR

Screening customers against sanction lists with advanced AML Screening Software

Generating AML reports (including the comparison of Company and representative data with sanction lists)

Archiving activities in compliance with GIIF requirements

Why does your company need AML software?

Increasing requirements

With increasingly strict regulations, handling AML processes manually carries a high risk of errors, delays, and financial penalties. This requires advanced Anti Money Laundering Compliance Software to manage risk effectively.

Complex processes

Verifying PEP status and continuously screening customers against sanction lists are now highly complex and time-consuming processes. A manual approach increases the risk of human error or overlooking clients subject to sanctions.

Risk exposure

AML process automation is no longer just a convenience but a necessity to ensure full regulatory compliance and effective risk management. AML Track enables companies to scale compliance processes, increase operational efficiency, and significantly reduce both operational and legal risks.

Benefits of implementing AML tools

Implementing AML Track translates into tangible business benefits and regulatory compliance. As one of the leading Anti Money Laundering Tools, it ensures efficiency, security, and adaptability.

FULL REGULATORY COMPLIANCE

FULL REGULATORY COMPLIANCE

Our AML Track is a complete AML Compliance Software that supports fulfilling obligations imposed by the AML Act and international standards, minimizing the risk of severe financial penalties in the event of an audit. This ensures that the institution remains legally compliant while reducing the workload.

TIME AND COST SAVINGS

TIME AND COST SAVINGS

Automation of key processes (such as customer verification) relieves employees and speeds up procedures. Eliminating manual list searches reduces the risk of human error and lowers the overall cost of ensuring compliance.

EFFICIENCY AND SCALABILITY

EFFICIENCY AND SCALABILITY

The system is effective for both small businesses and large institutions – the solution is scalable and tailored to all types of obliged entities.

UP-TO-DATE AND COMPREHENSIVE

UP-TO-DATE AND COMPREHENSIVE

Sanction databases are regularly updated, ensuring the immediate detection of sanctioned entities. A single tool replaces multiple separate databases and spreadsheets – all information (customer data, relationships, alerts, decisions) is available in one integrated system.

DATA SECURITY

DATA SECURITY

Our AML software meets high IT security standards. It ensures, among others, encrypted data transmission (SSL) and full compliance with personal data protection regulations, guaranteeing that sensitive client information and analysis results are properly secured.

INTUITIVE OPERATION AND FAST IMPLEMENTATION

INTUITIVE OPERATION AND FAST IMPLEMENTATION

A simple user interface and a dedicated implementation process ensure that employees quickly adopt the solution and can effectively carry out AML tasks from day one.

The implementation of a modern Anti-Money Laundering solution translates into enhanced security of financial operations, streamlined internal procedures, and protection of the company’s reputation. With next-generation AML tools, the organization can proactively identify and block money laundering attempts, AML verification becomes fast and reliable, and the company gains full confidence in meeting legal requirements for anti-money laundering compliance.

AML Track in action – how it works

Quick start – you receive a Client Administrator account and can create Users within your organization. You immediately gain access to AML tools.

Counterparty data is analyzed using predefined scoring models. Any data inconsistencies or presence on sanction lists trigger automatic alerts.

You create profiles of customers and counterparties – individuals or companies – by entering identification data, address details, PEP status, and ultimate beneficial owners.

Raporty tworzone są automatycznie lub na żądanie – z pełną historią dopasowań, poziomem zgodności i szczegółami porównań pól.

The system updates and verifies data based on national and international sanction lists, including the EU sanctions list, eliminating the need for manual searches and acting as a powerful sanction list scanner.

All data is stored in one secure system, making audits, reporting, and the daily work of compliance teams easier.

Why choose AML software from TTMS and Sawaryn & Partners Law Firm?

TTMS is a reliable and experienced software house that has been successfully delivering complex technology projects worldwide for over 10 years. We specialize in developing secure, scalable IT solutions for the financial, insurance, and many other regulated industries.

Meanwhile, the Sawaryn & Partners Law Firm provides expert legal and compliance support, drawing on its own experience also as an obliged institution. Together, we deliver tailored AML Compliance Software Solutions, ensuring that your company is protected and fully aligned with EU and Polish regulations.

By choosing TTMS and the Sawaryn & Partners Law Firm, you can be confident that your compliance processes are in the best hands.

Learn more about AML

KYC as the Foundation of AML Compliance – Role in Preventing Financial Crime and Requirements of 5AMLD/6AMLD

KYC as the Foundation of AML Compliance – Role in Preventing Financial Crime and Requirements of 5AMLD/6AMLD KYC (Know Your Customer) is the process of verifying the identity and credibility of clients, which forms the basis of compliance with AML (Anti-Money Laundering) regulations. Thanks to an effective KYC process, financial institutions and other businesses can ensure who they are entering into relationships with, preventing their services from being misused for financial crime such as money laundering or terrorism financing. EU regulations – including the 5th and 6th AML Directives (5AMLD, 6AMLD) – require companies to implement solid KYC procedures as part of their broader AML program. This article explains the importance of the KYC process as the foundation of AML compliance, its role in preventing financial crime, its connection to EU regulations (5AMLD, 6AMLD), and the requirements imposed on companies in the EU. It is aimed at business audiences – banks, financial institutions, real estate firms, law firms, accounting offices, and other obligated entities – who want to understand how to implement an effective KYC process and integrate it with AML solutions. What is the KYC Process and Why Is It Crucial? The KYC process is a set of procedures designed to thoroughly know the customer. It includes identifying and verifying the client’s identity using independent and reliable documents and information, as well as assessing the risks associated with the business relationship. In other words, a company checks who the client is, where their funds come from, and the purpose of the relationship. KYC is essential because it prevents serving anonymous clients or those using false identities and helps detect potentially suspicious circumstances already at the onboarding stage. The KYC process is considered the foundation of AML compliance, as without proper client identification further anti-money laundering activities would be ineffective. Adhering to KYC procedures enables, among other things, establishing the true identity of the customer, learning the source of their funds, and assessing the level of risk, thus forming the first line of defense against the misuse of a company for criminal purposes. Companies that implement effective KYC better protect their reputation and avoid engaging with clients who carry unacceptable risk. Key elements of the KYC process include, among others: Customer Identification (CIP) – collecting the customer’s basic personal data (e.g., name, address, date of birth, national ID or tax number in the case of a company) and copies of identity and registration documents as the first step in establishing the relationship. Identity Verification – confirming the authenticity of collected data using documents (ID card, passport), public registers, or other independent sources. Modern e-KYC tools are often used, such as biometric verification of documents and facial recognition, to quickly and accurately verify the client. Ultimate Beneficial Ownership (UBO) – identifying the natural person who ultimately controls a client that is a legal entity. This requires determining the ownership structure and often consulting registers such as the Central Register of Beneficial Owners. Customer Due Diligence (CDD) – analyzing and assessing customer risk based on the information collected. This includes checking whether the client appears on sanctions lists or is a politically exposed person (PEP), as well as understanding the client’s business profile and the purpose and nature of the relationship. Standard CDD applies to most customers with a typical risk profile. Enhanced Due Diligence (EDD) – in-depth verification for high-risk clients. If a client is deemed high risk (e.g., a foreign politician, operating in a high-risk country, or carrying out very large transactions), the institution must apply enhanced security measures: request additional documentation, monitor transactions more frequently, and obtain senior management approval to establish or maintain the relationship. Ongoing Monitoring – the KYC process does not end once the client has been onboarded. It is crucial to continuously monitor customer activity and transactions to detect potential suspicious actions. This includes regular updates of client information (periodic refresh of KYC data), analyzing transactions for consistency with the customer’s profile, and reacting to red flags (e.g., unusually large cash deposits). All of the above elements make up a comprehensive “Know Your Customer” process, which is the cornerstone of secure business operations. Best practices require documenting all KYC activities and retaining the collected data for the legally mandated period (usually 5 years or more). This allows the institution to demonstrate to regulators that it fulfills its KYC/AML obligations and properly manages customer risk. The Role of KYC in Preventing Financial Crime Strong KYC procedures are essential for preventing financial crime. By thoroughly knowing the customer, companies can identify red flags pointing to potential money laundering, terrorism financing, or fraud at an early stage. For example, verifying the client’s identity and source of funds may reveal that the person appears in suspect registers or originates from a sanctioned country – requiring enhanced scrutiny or refusal of cooperation. KYC provides critical input data to AML systems. Information gathered about the customer (e.g., identification data, PEP status, transaction profile) feeds analytical engines and transaction monitoring systems. This enables automated comparison of the customer’s behavior against their expected risk profile. If the customer begins conducting unusual operations – for example, significantly larger transactions than usual or transfers to high-risk jurisdictions – the AML system will detect anomalies based on KYC data and generate an alert. In this way, KYC and AML work together to prevent illegal financial activities. Good KYC increases the effectiveness of transaction monitoring and makes it easier to identify truly suspicious activities, while at the same time reducing the number of false alerts. In addition, fulfilling KYC obligations deters potential criminals. A financial institution that requires full identification and verification becomes less attractive to those attempting to launder money. From a company’s perspective, effective KYC not only prevents fines and financial losses associated with (even unintentional) involvement in criminal activity, but also protects its reputation. In sectors such as banking or real estate, trust is key – and implementing high KYC standards builds the institution’s credibility in the eyes of both clients and regulators. EU AML Regulations: 5AMLD, 6AMLD and KYC Obligations for Companies The European Union has developed a comprehensive set of AML/KYC regulations designed to harmonize and strengthen the fight against money laundering across all Member States. The main legal acts are successive AML Directives: 4AMLD, 5AMLD and 6AMLD (the fourth, fifth and sixth Anti-Money Laundering Directives). These directives have been transposed into national law (in Poland through the Act of March 1, 2018 on Counteracting Money Laundering and Terrorist Financing) and impose on obligated institutions a range of requirements related to KYC and AML. Obligated institutions include all entities operating in sectors particularly exposed to the risk of money laundering. These cover not only banks and investment firms, but also insurers, brokerage houses, payment institutions, and currency exchange offices, as well as non-financial entities – such as notaries, lawyers (when handling clients’ financial transactions), tax advisors, accounting offices, real estate brokers, auction houses and art galleries (selling luxury goods), cryptocurrency exchanges, and lending companies. All of these entities are legally required to apply KYC and AML procedures. They must implement internal policies and procedures that ensure customer identification, risk assessment, transaction registration and reporting, as well as staff training on AML regulations. 5th AML Directive (5AMLD), effective from January 2020, introduced significant extensions to KYC obligations. Among other things, the list of obligated institutions was expanded – for the first time including cryptocurrency exchanges and wallet providers, who are now required to conduct full KYC on their users and report suspicious operations. 5AMLD also emphasized greater transparency of company ownership information by mandating public access to registers of beneficial owners of companies in the EU, making it easier for institutions to access ownership data of corporate clients. Additional security measures were introduced for transactions with high-risk countries, and thresholds for certain transactions requiring KYC were lowered (e.g., for occasional transactions involving virtual currencies, the threshold was set at EUR 1000). For financial institutions and other firms, this meant updating KYC/AML procedures – adapting them to cover new types of clients and transactions, and to use new registers. 6th AML Directive (6AMLD), transposed by Member States by December 2020, focuses on harmonizing definitions of money laundering offenses and tightening sanctions. It introduced a common EU-wide list of 22 predicate offences, the commission of which is considered the source of “dirty money” subject to money laundering. Among these offences, cybercrime was added for the first time in EU AML regulations. 6AMLD required EU countries to introduce laws providing harsher penalties for money laundering – across the Union, the minimum maximum prison sentence for this crime must be at least 4 years. Another important element of 6AMLD is the extension of criminal liability to legal entities (companies). A business can be held liable if, for example, its management allows money laundering to occur within the company’s operations or fails to meet oversight obligations. In practice, 6AMLD forces companies to take even greater care with compliance – lapses in AML controls can result in severe legal consequences not only for employees but also for the organization itself. The EU directives translate into specific KYC/AML requirements for companies. Every obligated institution in the EU must apply so-called customer due diligence measures, which include: identification and verification of the customer and beneficial owner, assessment of the purpose and nature of the business relationship, ongoing monitoring of customer transactions, and retaining collected information for at least 5 years. For high-risk clients, enhanced due diligence (EDD) is required, such as obtaining additional information on the sources of wealth or closer monitoring of transactions. Companies must also maintain a register of transactions above defined thresholds and report suspicious transactions to the competent authorities (e.g., in Poland, to GIIF). In addition, regulations require companies to appoint an AML Officer responsible for oversight and to regularly train staff on current AML rules. Failure to comply with KYC/AML obligations carries serious sanctions. Regulators may impose high administrative fines – up to 5 million euros or 10% of annual company turnover for severe violations. They may also apply other measures such as a temporary ban on conducting certain activities or public disclosure of the violation, exposing the firm to major reputational damage. In addition, individuals (e.g., management board members) may face criminal liability – in Poland, money laundering is punishable by up to 12 years of imprisonment. All this means that adhering to AML regulations and diligently carrying out the KYC process is not just a legal duty, but a matter of business survival and security. Implementing an Effective KYC Process and Integration with AML Solutions To meet legal requirements and genuinely reduce risk, companies must not only formally implement KYC procedures but do so effectively and integrate them with the overall AML system. Below are the key steps and best practices for building an effective KYC process and linking it to broader AML activities: Risk assessment and AML/KYC policy: An organization should begin with a risk assessment of money laundering related to its activities and types of clients. Based on this, it develops an internal AML/KYC policy defining customer identification procedures, division of responsibilities, incident reporting, etc. A risk-based approach ensures resources are directed where risk is highest – e.g., stricter procedures for clients from high-risk countries or sectors. Customer identification and verification procedures: The company should implement standardized procedures for collecting and verifying data from new clients. Increasingly, digital solutions streamline KYC – for example, remote identity verification apps using document scanning and biometric facial verification. It is also important to check clients in available registers and databases, such as EU/UN sanctions lists and PEP databases, which can be automated using specialized software. Identifying beneficial owners in corporate clients: For business or organizational clients, it is essential to determine their ownership structure and identify the natural persons who ultimately control the entity (UBOs). Central registers of beneficial owners (such as CRBR in Poland) can help, but under 5AMLD institutions cannot rely solely on these registers – they should independently verify information and document any difficulties in identifying the owner. Integrating KYC data with transaction systems: All customer information obtained during KYC should be used in ongoing monitoring. Ideally, the company’s banking or financial system should be integrated with an AML module so that the client’s risk profile influences transaction monitoring. For example, a high-risk client will be subject to more frequent and detailed analysis. KYC data feeds AML scoring engines, enabling automatic detection of unusual behavior and faster response. Such integration also reduces data silos and the risk of overlooking important client information. Automation and modern technologies: Implementing dedicated IT solutions can significantly increase effectiveness and reduce the costs of KYC/AML. For example, AI-based systems can analyze customer behavior and transactions in real time, while machine learning helps detect unnatural patterns that may indicate money laundering. Robotic Process Automation (RPA) is used to automatically extract and verify data from documents (OCR), reducing human error. Research shows that automation and KYC/AML integration can shorten new customer verification time by up to 80% and drastically cut errors. As a result, compliance improves while customer onboarding becomes faster and less burdensome. Training and compliance audits: Technology alone cannot replace human factors. Staff must be properly trained in KYC/AML procedures and know how to recognize warning signs. Companies should regularly conduct training for frontline employees and management, and also perform periodic internal compliance audits. Audits help identify gaps or irregularities in fulfilling KYC/AML obligations and implement corrective actions before an external regulator’s inspection. In summary, effective implementation of the KYC process requires a combination of people, procedures, and technology. Obligated institutions should treat KYC not as a burden, but as an investment in the security of their business. An integrated KYC/AML process ensures compliance with regulations, early detection of abuse attempts, increased operational efficiency, and trust-building with clients and business partners. In the dynamic EU regulatory environment (with further changes underway, including the establishment of a pan-European AML authority – AMLA), companies must continuously refine their KYC/AML procedures to stay ahead of financial criminals and meet growing supervisory demands. Most Common Questions about KYC/AML (FAQ) What is the KYC process and what is its purpose? The KYC (Know Your Customer) process is a set of procedures aimed at knowing and verifying the customer’s identity. Its purpose is to confirm that the client is who they claim to be and to understand the risks associated with serving them. As part of KYC, the institution collects personal data and documents (e.g., ID card, company registration documents), verifies their authenticity, and assesses the client’s profile (including sources of funds, type of business activity). The goal of KYC is to protect the company from engaging with imposters, dishonest clients, or those involved in money laundering or terrorism financing. In short – thanks to KYC, a company knows who it is dealing with and can consciously manage the associated risks. How is KYC different from AML? KYC and AML are related but distinct concepts. KYC focuses on knowing the customer – it is the process of identifying and verifying client data and assessing risk before and during the business relationship. AML (Anti-Money Laundering), on the other hand, is a broader system of regulations, procedures, and actions aimed at preventing money laundering and terrorist financing across the organization as a whole. In other words, KYC is one element of the overall AML program. In practice, AML includes not only the initial verification of the customer (KYC), but also ongoing transaction monitoring, behavioral analysis, detection of suspicious patterns, and reporting of suspicious transactions to the relevant authorities. KYC provides the input – knowledge of who the customer is and their characteristics – while the AML system uses this data for comprehensive oversight of financial activity after the relationship has begun. Both elements must work closely together: even the best AML transaction monitoring tools will not function effectively if the company knows nothing about its clientele (lack of KYC), and conversely – KYC alone without subsequent monitoring will not be enough to detect unusual transactions conducted by an apparently “normal” client. Which EU regulations govern KYC/AML obligations (5AMLD, 6AMLD)? In the European Union, the legal framework for KYC/AML obligations is set out in successive AML directives. 4AMLD (Directive 2015/849) introduced the risk-based approach and the requirement to create central registers of beneficial owners of companies. 5AMLD (Directive 2018/843) expanded the scope of regulation – bringing crypto exchanges and wallet providers into the AML regime, placing greater emphasis on beneficial ownership identification (including public access to UBO registers), and tightening rules for cooperation with high-risk countries. 6AMLD (Directive 2018/1673) harmonized definitions of money laundering offenses across the EU and strengthened criminal aspects – it identified 22 predicate offenses, introduced stricter minimum penalties (Member States must provide at least 4 years maximum imprisonment for money laundering), and extended criminal liability to legal entities. In practice, this means that companies in the EU must comply with uniform standards for client identification, verifying their status (e.g., whether they are on a sanctions list), and monitoring transactions. National laws (such as Poland’s AML Act) implement these directives by imposing specific obligations on obligated institutions: applying customer due diligence in defined scenarios, reporting suspicious and above-threshold transactions, retaining documentation, appointing an internal AML Officer, etc. Furthermore, EU regulations are continuously evolving – in 2024, the AML package was agreed, which includes the establishment of an EU-wide AML authority (AMLA) and the introduction of a new AML regulation, further unifying the approach to KYC/AML across the Union. Which companies are subject to KYC/AML obligations? KYC and AML obligations apply to so-called obligated institutions, entities designated by law as particularly exposed to the risk of money laundering or terrorist financing. The list is broad. It traditionally includes all financial institutions: banks (including foreign branches), credit unions, brokerage houses, insurance companies (especially life insurers), investment funds, payment institutions, and currency exchange offices. In addition, AML obligations also apply to notaries, lawyers (when handling clients’ financial transactions such as property deals or company formation), tax advisors, auditors, and accounting offices. The catalog of obligated institutions also includes real estate agents, businesses dealing in luxury goods (e.g., antiques, works of art, precious stones – if transactions exceed a set threshold), and, since 5AMLD, crypto exchanges and wallet providers. As a result, the duty to implement KYC/AML procedures rests on a very wide range of companies – not only banks. Each of these institutions must identify their clients, monitor their transactions, and report suspicions to state authorities. It is worth noting that even companies outside the official list of obligated institutions often voluntarily adopt KYC/AML measures (e.g., fintechs not under full supervision), as this is seen as good business practice and a way to build customer trust. How to effectively implement KYC in a company and integrate it with AML? Implementing an effective KYC process requires a multi-layered approach – combining clearly defined procedures, trained personnel, and the right technological tools. Here are a few steps and principles to achieve this goal: 1. Set the framework and risk assessment: Begin by defining an AML/KYC policy tailored to the company’s profile. It should state when KYC measures must be applied (e.g., at the start of every client relationship or for transactions above a certain threshold) and who is responsible. At the same time, conduct a risk assessment to identify business areas and client types most vulnerable to money laundering. The results help focus attention where risk is highest. 2. Apply appropriate identification procedures: Collecting complete information from the client and verifying its authenticity is crucial. Prepare lists of acceptable identity and registration documents and establish verification procedures. Increasingly, remote verification tools (e-KYC) are used, such as automatic reading of ID data and comparing the photo in the document with the client’s live facial image. These technologies speed up the process and reduce human error. 3. Screen clients against external databases: A key part of KYC is checking whether the client appears on international sanctions lists or in PEP databases. Manual searching is inefficient – it is better to use screening systems that automatically compare client data against constantly updated lists. This way, the company immediately knows if a prospective client is sanctioned or holds a prominent public function, requiring additional measures (EDD). 4. Identify beneficial owners: For corporate clients, you must establish who ultimately owns and controls the entity. Obtain current extracts from registers (e.g., national company registers) and use beneficial ownership registers to understand the ownership structure. For complex ownership (e.g., subsidiaries of foreign holdings), request organizational charts or declarations. Record every step – regulations require documenting difficulties in identifying UBOs. 5. Link KYC with transaction monitoring: The data collected during KYC should be used in ongoing monitoring. A client’s risk profile should influence transaction monitoring parameters. Modern AML systems define detection scenarios using KYC data (e.g., different thresholds for low-risk vs. high-risk clients). Ensuring automatic, real-time integration between KYC databases and transaction systems is critical. This integration allows anomalies to be detected more quickly and improves the effectiveness of the entire AML program. 6. Use technology and automation: Investing in RegTech solutions improves efficiency. For example, AML platforms can score risk automatically using KYC data, and AI-based systems can analyze transactions in real time, learning normal behavior patterns and generating alerts for anomalies. Automation reduces manual work like retyping data (OCR handles it) or creating reports. Studies show that RegTech solutions can cut onboarding time by up to 80% and reduce errors and false positives, letting compliance staff focus on truly suspicious cases. 7. Train staff and ensure compliance audits: Even the best procedures will fail if people do not follow them or do not understand their purpose. Regular AML/KYC training is mandatory – both at onboarding new employees and periodically (e.g., annually) for all staff. Training reinforces the ability to spot suspicious activity and respond properly. Management should also ensure independent internal audits of AML/KYC procedures to verify compliance, documentation completeness, and system effectiveness. Audit results enable corrective actions before regulators uncover issues. Implementing an effective KYC process is continuous, not a one-off project. AML regulations evolve, new risks (e.g., from cryptocurrencies or emerging fintech) appear, so companies must continuously adapt. Still, investing in robust KYC/AML processes brings multiple benefits – avoiding fines, protecting reputation, and creating a transparent, secure business environment that supports long-term growth. What are the most common mistakes companies make when implementing KYC? One of the most common mistakes is approaching KYC as a one-off obligation rather than a continuous process. Organizations often fail to update client information, rely too much on manual checks instead of using automation, or overlook the importance of training employees. These shortcomings create compliance risks and reduce the effectiveness of the entire AML framework. How does KYC affect the customer experience? When properly implemented, KYC can actually improve customer experience. Automated e-KYC tools allow customers to go through onboarding faster and with fewer documents, often in a fully digital process. Clear communication and user-friendly design help reduce frustration, while strong verification builds trust and confidence in the institution. Is KYC only relevant for the financial sector? KYC obligations extend far beyond traditional banks and insurers. Real estate agencies, law firms, accounting offices, luxury goods dealers, art galleries, casinos, and cryptocurrency exchanges are also required to conduct KYC under EU directives. Even companies outside the formal list of obligated entities increasingly adopt KYC voluntarily to safeguard their reputation and business relationships. How is automation changing the KYC process? Automation has become a game changer for KYC. Artificial intelligence, RegTech, and robotic process automation allow firms to handle large volumes of customer data more efficiently. Automated sanctions screening, biometric ID verification, and real-time monitoring reduce errors and free up compliance teams to focus on genuinely suspicious cases. What does the future of KYC look like beyond 2025? KYC is expected to integrate with digital identity initiatives across the EU, making verification faster and more secure. Technologies such as blockchain analytics, biometric authentication, and cross-border data sharing will become standard. With the creation of the EU AML Authority (AMLA), supervision will become more centralized and harmonized, ensuring higher consistency and stricter enforcement across Member States.

Read moreThe Best Anti-Money Laundering (AML) Software in 2026: A Comprehensive Ranking of the Top 10 Vendors

10 Best Anti-Money Laundering Software in 2026 Businesses across the financial and fintech sectors are turning to advanced anti-money laundering software to automate AML compliance and protect against financial crime. In Poland – where regulatory pressure from EU directives (like the 6AMLD) and local authorities is intensifying – organizations are increasingly adopting top AML software to meet Know Your Customer (KYC) and sanctions screening obligations efficiently. This 2025 ranking highlights the top 10 AML software vendors, including global market leaders and innovative solutions available to businesses operating in Poland. Read on to discover the best AML software platforms for banks and enterprises, and how they help streamline compliance through AI-driven transaction monitoring software, sanctions screening tools, and KYC solutions. 1. AML Track (TTMS) – AI-Powered AML Automation Platform AML Track by Transition Technologies MS (TTMS) is a comprehensive anti-money laundering software developed in Poland that leverages AI to automate KYC verification and sanctions screening. Co-created with the law firm Sawaryn & Partners, AML Track enables rapid customer due diligence, real-time screening against global sanctions lists, and automated risk assessment – all in one centralized platform. The system integrates with Polish, EU, UK and other international databases, ensuring up-to-date coverage of sanctioned entities. By eliminating manual checks across multiple registries, AML Track helps financial institutions reduce false positives and close compliance gaps while significantly speeding up customer onboarding and ongoing monitoring. Key features of AML Track include guided KYC workflows, automatic data fetching from national registers (CEIDG, KRS, CRBR in Poland), continuous client screening against sanctions and watchlists, and one-click generation of required compliance documentation (e.g. KYC reports, ultimate beneficial owner verification, risk assessment forms). All compliance activity is securely logged and archived in line with regulatory requirements, simplifying audits by Poland’s financial intelligence unit (GIIF). Sanctions screening software is a core strength – AML Track’s rapid integration with domestic and international watchlists minimizes the risk of missing a flagged individual or organization. The platform’s intuitive interface and encrypted API connectivity allow for quick deployment and seamless integration into existing IT systems. By automating complex AML processes, TTMS’s AML Track helps organizations ensure full regulatory compliance while saving time and costs. The solution scales from small firms to large banks, providing high performance and best-in-class AML software for banks and other obligated institutions. It also prioritizes data security – with robust encryption and privacy safeguards – so that sensitive client information and alerts remain protected. Backed by TTMS’s decade-long IT expertise and Sawaryn & Partners’ legal compliance know-how, AML Track stands out as a modern AML/KYC solution that allows Polish businesses to proactively detect and block money laundering attempts, maintain continuous sanctions screening, and confidently meet evolving anti-money laundering regulations. AML Track: software snapshot Vendor: TTMS & Sawaryn & Partners Headquarters: Warsaw, Poland Website: https://ttms.com/ Main solutions: Automated KYC/AML platform, sanctions screening tools, transaction monitoring, risk scoring engine, compliance reporting 2. NICE Actimize – Comprehensive Financial Crime Compliance Suite NICE Actimize is one of the top AML software vendors, delivering an AI-driven suite for transaction monitoring, customer due diligence, and sanctions screening for institutions of all sizes. Its entity-centric platform applies machine learning to detect suspicious behavior in real time while strengthening auditability and regulatory coverage. Known for some of the best transaction monitoring software, Actimize provides configurable rules and analytics that reduce false positives and prioritize high-risk alerts. Banks also use it for currency transaction reporting, fraud detection, and case management embedded in AML workflows. With hundreds of clients worldwide, including leading banks in Europe and Poland, NICE Actimize is a scalable, end-to-end choice for modern AML compliance. NICE Actimize: software snapshot Vendor: NICE Ltd (Actimize) Headquarters: Ra’anana, Israel (global offices in New York and worldwide) Website: https://www.niceactimize.com Main solutions: Transaction monitoring, watchlist sanctions screening, customer risk scoring, fraud detection, case management 3. SAS Anti-Money Laundering – Analytics-Driven AML Solution SAS Anti-Money Laundering (part of SAS’s Financial Crimes Suite) is an analytics-driven AML software platform with end-to-end capabilities: transaction monitoring, sanctions and PEP screening, alert management, and regulatory reporting. Built on SAS’s advanced analytics engine, it applies machine learning for anomaly detection and scenario modeling to address laundering risks proactively. Chosen by global banks for scale and complex risk models, SAS AML is configurable to each institution’s risk appetite and jurisdiction, including Polish and EU requirements. It is cloud-ready and AI-enhanced to reduce false positives and costs, with strong vendor support and R&D. A top option for organizations seeking analytics-first compliance and a unified view of financial crime risk. SAS Anti-Money Laundering: software snapshot Vendor: SAS Institute Inc. Headquarters: Cary, NC, USA Website: https://www.sas.com Main solutions: Transaction monitoring with analytics, watchlist screening (sanctions/PEPs), regulatory reporting, enterprise case management, fraud and financial crime analytics 4. Oracle Financial Crime and Compliance Management – Scalable Bank-Focused AML Oracle delivers a broad suite of financial crime compliance tools through its Financial Crime and Compliance Management (FCCM) platform, formerly known as Mantas. Widely adopted by large banks, it offers enterprise-grade transaction monitoring software, customer screening, and configurable rules with risk scoring for detecting suspicious activities across jurisdictions. With real-time filtering and watchlist checks, Oracle supports OFAC, EU, and UN compliance while scaling to millions of daily transactions. Its reliability, integration with core banking, and strong vendor support make FCCM a proven AML software for banks that need enterprise-level compliance and adaptability to local regulatory requirements. Oracle FCCM (Financial Crime and Compliance Management): software snapshot Vendor: Oracle Corporation Headquarters: Austin, TX, USA Website: https://www.oracle.com Main solutions: AML transaction monitoring, real-time sanctions screening tools, KYC modules, case management, regulatory reporting 5. LexisNexis Risk Solutions – Integrated Watchlist Screening and KYC Tools LexisNexis Risk Solutions is a global provider of AML compliance software and services, known for its extensive databases and analytics. Its tools support sanctions screening, customer risk scoring, fraud detection, and include solutions like Bridger Insight XG to check customers against sanctions, PEP, and negative news lists. By integrating multiple sanctions screening sources, LexisNexis simplifies compliance workflows and enhances onboarding and KYC reviews. With global reach and strong EMEA presence, it offers Polish businesses and international institutions a reliable AML/KYC solution with rich data coverage and proven effectiveness. LexisNexis Risk Solutions: software snapshot Vendor: LexisNexis Risk Solutions (RELX Group) Headquarters: Alpharetta, GA, USA Website: https://risk.lexisnexis.com Main solutions: Watchlist and sanctions screening (global lists, adverse media, PEP), customer due diligence workflow tools, identity verification, fraud prevention and risk scoring analytics 6. ComplyAdvantage – AI-Driven AML and Risk Intelligence Platform ComplyAdvantage is a London-based AML software provider recognized for its AI-driven approach. Its platform delivers real-time screening of sanctions, watchlists, PEPs, and adverse media through a continuously updated global risk database, with machine learning designed to reduce false positives. Offering one of the best AML service experiences, ComplyAdvantage provides a unified dashboard, case management tools, and robust APIs for onboarding and transaction monitoring. Cloud-based and scalable, it supports banks, fintechs, and even smaller firms in Europe, including Poland, with advanced yet accessible AML technology. ComplyAdvantage: software snapshot Vendor: ComplyAdvantage Headquarters: London, UK Website: https://complyadvantage.com Main solutions: Real-time customer screening (sanctions, PEP, adverse media), AI-powered transaction monitoring, risk scoring and alerts, case management, API-driven integrations 7. Fenergo – Client Lifecycle Management with Integrated AML Fenergo, an Irish provider of Client Lifecycle Management (CLM) software, offers robust AML/KYC compliance modules alongside its onboarding workflows. Initially known for managing KYC documents and regulatory classifications, it has expanded into transaction monitoring and screening, creating an end-to-end compliance and onboarding platform. Its strength lies in combining the client journey with compliance checks, from KYC verification to continuous monitoring. Widely used by global banks and firms in Poland, Fenergo streamlines siloed processes and remains one of the top AML software vendors for organizations seeking unified client management and compliance. Fenergo: software snapshot Vendor: Fenergo Headquarters: Dublin, Ireland Website: https://www.fenergo.com Main solutions: Client lifecycle management, KYC & AML compliance, transaction monitoring, regulatory rules engine, case management 8. Napier – Next-Gen Intelligent AML Platform Napier (Napier AI) is a UK-based provider of next-generation AML software that emphasizes artificial intelligence and machine learning. Its platform is fast, scalable, and configurable, offering AI-driven transaction monitoring systems, client screening with advanced name-matching, and a central risk hub for oversight. Focused on AI for anomaly detection, Napier learns from data to reduce false alerts and offers a sandbox, Napier Continuum, for testing detection models. With real-time sanctions screening tools and a user-friendly interface, it has earned recognition in Europe and Asia as one of the top 10 AML software solutions for fintechs and forward-looking institutions. Napier (Napier AI): software snapshot Vendor: Napier AI Headquarters: London, UK Website: https://napier.ai Main solutions: AI-powered transaction monitoring, client/customer screening (sanctions, PEP, adverse media), case management & workflow automation, AML analytics and reporting 9. Quantexa – Contextual Decision Intelligence for AML Quantexa, a UK-based tech company, offers a contextual decision intelligence platform used to enhance detection and AML investigation capabilities. By building networks of people, accounts, and entities from multiple data sources, it helps institutions uncover hidden relationships and complex laundering schemes that rule-based systems miss. Its augmented intelligence tools highlight hidden links, score risks, and strengthen visibility, effectively boosting existing AML controls. Adopted by major European banks, Quantexa stands out as one of the best AML software ecosystem providers for organizations seeking advanced analytics and deeper investigative intelligence. Quantexa: software snapshot Vendor: Quantexa Headquarters: London, UK Website: https://www.quantexa.com Main solutions: Contextual network analytics, entity resolution, relationship mapping for KYC/AML, alert investigation tools, data fusion for 360-degree risk views 10. Lucinity – User-Friendly AI Platform to “Make Money Good” Lucinity, an AML software company from Iceland, focuses on humanizing compliance through AI and user-centric design. Its cloud-based platform offers transaction monitoring, behavior analytics, case management, and SAR reporting with simplicity and transparency, blending AI-driven detection with human insights. A standout feature is its storytelling interface, which explains why alerts are triggered and speeds up investigations. Continuously learning AI reduces false positives while remaining explainable. With offices in New York, London, and Reykjavík, Lucinity is growing quickly and is one of the top AML companies to watch in 2025 for agile and modern compliance. Lucinity: software snapshot Vendor: Lucinity Headquarters: Reykjavík, Iceland (offices in New York and London) Website: https://www.lucinity.com Main solutions: AML transaction monitoring, suspicious behavior detection, automated SAR reporting, AML/KYC analytics dashboards, case management How to Pick the Right AML Software in 2025? Selecting the right AML software depends on the size of your organization, your regulatory environment, and the risks you face. All of the solutions in this top 10 ranking provide excellent tools to support compliance, protect against money laundering, and streamline KYC and sanctions screening. For businesses operating in Poland and across Europe, these platforms deliver the technology and reliability needed to stay compliant and secure. Why TTMS is the #1 Choice for AML Software in 2025 While all the vendors in this ranking deliver excellent AML solutions, TTMS with its flagship platform AML Track stands out as the top choice for organizations seeking a trusted, innovative, and future-proof AML/KYC solution. What makes TTMS different is not only the cutting-edge technology behind AML Track, but also the unique blend of IT expertise and legal compliance know-how that ensures maximum value for clients. Expertise in AML Automation: TTMS has a dedicated compliance technology team that specializes in building scalable and secure financial solutions. Combined with the legal insights of Sawaryn & Partners, the AML Track platform covers the entire spectrum of regulatory obligations – from sanctions screening to transaction monitoring – with unmatched precision. Proven Track Record Across Industries: TTMS delivers technology solutions to banks, insurers, real estate firms, accounting offices, and many other regulated businesses. This broad experience ensures that AML Track can be adapted to the unique requirements of any industry, providing practical workflows, faster onboarding, and reduced compliance risks. End-to-End Service and Support: From the first consultation through implementation and ongoing maintenance, TTMS ensures a smooth AML journey. Clients benefit from tailored onboarding, staff training, and continuous technical support. This holistic approach guarantees long-term compliance, even as regulations evolve. Innovation and Continuous Improvement: TTMS invests in AI, machine learning, and automation to keep AML Track ahead of the curve. The system minimizes false positives, integrates seamlessly with national and EU registers, and is updated in line with the latest regulatory changes. This proactive development ensures clients stay compliant while benefiting from the most advanced AML technology. Local Expertise, Global Standards: With headquarters in Poland and international project experience, TTMS combines local market understanding with world-class delivery standards. Clients receive responsive, culturally aligned support while gaining access to globally proven compliance practices. TTMS: Your Next Step in AML Compliance TTMS leads the 2025 AML software ranking because it combines technical excellence, deep regulatory knowledge, and a client-first approach. For any organization – whether in Poland or internationally – that needs to safeguard operations, ensure regulatory compliance, and protect its reputation, AML Track by TTMS is the most compelling solution on the market. Looking for a trusted AML partner to protect your business? Discover how TTMS can support your compliance journey at: TTMS Website. What industries can benefit the most from AML software in 2025? While AML software is mandatory for banks, insurers, and payment providers, in 2025 its relevance is growing across a much wider set of industries. Real estate agencies, law firms, accounting offices, casinos, luxury goods dealers, and even art galleries are increasingly regulated under AML laws such as the EU’s 6AMLD. These industries face the same risks of being exploited for money laundering and therefore benefit from automated KYC checks, sanctions screening, and transaction monitoring. Beyond compliance, AML solutions also protect their reputation and enable faster onboarding of clients. How does AI improve AML compliance compared to traditional tools? Artificial intelligence allows AML platforms to go beyond rule-based checks by recognizing hidden patterns, anomalies, and connections between entities that manual methods often miss. AI reduces false positives by learning from historical alerts and prioritizing the most suspicious activities. This enables compliance teams to focus on high-risk cases instead of wasting time on irrelevant alerts. In practice, this means faster investigations, lower operational costs, and stronger protection against evolving money laundering tactics. Is cloud-based AML software secure enough for sensitive financial data? Modern cloud-based AML platforms are built with advanced encryption, multi-factor authentication, and continuous monitoring to meet strict financial security requirements. Reputable vendors also comply with international standards such as ISO/IEC 27001 and GDPR. In many cases, cloud deployments are even more secure than on-premise solutions, as updates and security patches are applied instantly across the system. For organizations in Poland and the EU, cloud AML software also typically offers data residency options to ensure compliance with local regulations. How quickly can an organization implement AML software? Implementation speed depends on the size of the institution and the complexity of its systems. Smaller firms can often start using a cloud-based AML platform within days, while large banks may need several months to fully integrate transaction monitoring and case management into their core systems. A key factor is whether the vendor provides ready API connections to national and EU databases, as well as onboarding support and training. Vendors like TTMS with AML Track emphasize rapid deployment by offering pre-configured templates and tailored implementation plans. What future trends will shape AML software beyond 2025? Looking ahead, AML solutions will increasingly integrate blockchain analytics, real-time cross-border transaction monitoring, and deeper integration with digital identity systems. Regulators are expected to demand even greater transparency and auditability of AML models, pushing vendors to invest in explainable AI. Another trend is the growing use of RegTech ecosystems, where AML platforms connect seamlessly with fraud detection, cyber security, and reporting tools, creating a unified compliance infrastructure. This evolution means that AML software will not only remain essential but will become a strategic asset for organizations fighting financial crime.

Read moreAML in the Art Market: Automation for Safe and Transparent Transactions

AML in the Art Market: Automation for Safe and Transparent Transactions Did you know that criminals launder an estimated $3 billion through art each year? The global art market – worth over $65 billion annually – has long been a target for illicit finance. Fraudsters and kleptocrats have taken advantage of the art world’s secrecy and soaring prices to turn “dirty” money into legitimate assets. This article explores why art is so attractive for money laundering and how European anti-money laundering (AML) laws – particularly the 5th AML Directive – impose new duties on art galleries and auction houses. We’ll also discuss the serious risks of non-compliance and how automation can help art businesses meet their AML obligations, ensuring safer, more transparent transactions. Why the Art Market Attracts Money Launderers The art market’s allure for money launderers comes down to its unique combination of high value and opacity. A painting or sculpture can be worth millions yet is easily portable and concealable. In fact, art is often described as an “ideal playground for money laundering”. Here are some key reasons why criminals turn to art: Anonymity and secrecy: Art sales have traditionally been private, with buyers and sellers able to remain anonymous through shell companies or agents. Until recently, dealers and auction houses had no legal obligation to identify clients or report suspicious activities, allowing illicit actors to operate in the shadows. High-value, portable assets: Artworks pack immense value into a small package – a single painting can be worth tens of millions. These assets can be moved across borders or kept in offshore storage with little detection. For example, small collectibles like rare coins or antiquities can be smuggled easily, making art a convenient vehicle to transfer wealth secretly. Subjective pricing: There’s no fixed “market price” for a masterpiece – value is in the eye of the beholder. This subjectivity lets criminals manipulate prices to launder funds. They might overpay for a piece using dirty money and later sell it for a “clean” profit, or trade art at an inflated or deflated price between colluding parties to obscure the money trail. Free ports and storage: Valuable art is often stored in tax-free port warehouses (in jurisdictions like Geneva or Monaco) that offer high security and anonymity. Art can sit in a free port for years “in transit,” changing ownership on paper without ever leaving the warehouse. This makes it easy to conduct secret transactions beyond the reach of most regulators. Cash purchases and intermediaries: Traditionally, art deals could be done in cash, and auction houses often dealt with intermediaries rather than the ultimate buyer. This meant the true source of funds could be obscured. Many major auction houses historically did not ask for the identity of the actual client or ultimate beneficial owner (UBO) behind a purchase. Such gaps have been exploited by money launderers to inject illicit cash into the art trade without scrutiny. These factors have led to notorious cases where art was used to launder money. In one U.S. case, drug traffickers accepted 33 paintings as payment for narcotics and planned to resell them to “clean” the money, a scheme that landed the perpetrators in prison. As law enforcement notes, the volume of questionable transactions in the art market is noticeably higher than in other sectors. Recognizing this vulnerability, authorities worldwide have begun closing the loopholes that made art a safe haven for illicit funds. EU AML Legislation: 5AMLD and the Art Sector In the European Union, regulators responded to the art market’s money-laundering risks by extending AML laws to art businesses. The Fifth Anti-Money Laundering Directive (5AMLD), which took effect January 2020, explicitly brought art dealers, galleries, and auction houses into the scope of AML regulation. Under 5AMLD’s definition, any “persons trading or acting as intermediaries in the trade of works of art, including when carried out by art galleries and auction houses,” as well as those storing or trading art in free ports, are considered “obliged entities” when transactions exceed €10,000. In practice, this means if you operate in the EU art market and engage in high-value sales (even as a series of linked transactions), you must follow the same AML requirements as banks and other financial institutions. Crucially, EU legislation requires a risk-based approach to AML in the art sector. Galleries and auction houses must assess the risk of money laundering in each transaction and client relationship, focusing more effort on higher-risk cases (such as unusual payments or politically exposed buyers). The 4th AML Directive had already covered businesses receiving large cash payments (≥ €10,000), but 5AMLD went further by targeting the art trade’s particular vulnerabilities. In short, anonymity is no longer an acceptable norm – European law now requires art market participants to disclose buyer and seller identities and scrutinize the source of funds. It’s also worth noting the Sixth Anti-Money Laundering Directive (6AMLD), which EU member states implemented starting 2021, strengthens penalties and enforcement. 6AMLD harmonizes the definition of money laundering across the EU and imposes tougher punishments on individuals and companies involved. For example, it sets a minimum prison term (often around four years) for serious money laundering offenses and can hold companies liable for facilitating money laundering. Together, 5AMLD and 6AMLD send a clear signal: art businesses in Europe must take AML compliance seriously, or face severe consequences. Key AML Obligations for Galleries and Auction Houses Under these EU directives (and equivalent UK regulations for British art market participants), galleries and auction houses now have concrete AML duties. In practice, art businesses must establish internal compliance programs similar to those in finance. The key obligations include: Client due diligence (CDD): Verify the identity of clients and collect relevant information before completing a sale. This “Know Your Customer” process means obtaining official ID documents, proof of address, and understanding the nature of the client’s business and funds. If the client is a company or buying through an agent, the gallery must identify the ultimate beneficial owner (UBO) – the real person behind the transaction – and verify their identity. Risk assessment and ongoing monitoring: Evaluate each client and transaction for risk factors (e.g. unusually high-value purchases, payments from high-risk countries, politically exposed persons) and apply proportional scrutiny. After onboarding, continue to monitor transactions for any red flags. Large or complex transactions that lack obvious economic rationale should prompt further inquiry into the source of funds. Galleries should also pay attention to any changes in a client’s profile or behavior over time. Screening against sanctions and PEP lists: Check clients’ names against international sanctions lists and databases of politically exposed persons (PEPs) as part of due diligence. If a collector is a sanctioned individual or a high-profile political figure, enhanced due diligence and potentially rejecting the transaction may be required. Similarly, scanning for adverse media (negative news) about clients can reveal involvement in fraud, corruption, or other crimes that pose money-laundering risk. Record-keeping: Maintain detailed records of transactions, customer identification data, and the steps taken to comply with AML requirements. EU rules typically require keeping these records for at least five years. This includes copies of IDs, invoices, contracts, provenance documentation, and internal notes on risk assessments. Good record-keeping ensures transparency and is invaluable if investigators ever scrutinize a transaction. Reporting obligations: If a transaction or client activity looks suspicious or involves funds known or suspected to be criminal in origin, the business must file a Suspicious Activity Report (SAR) with the national Financial Intelligence Unit. This legal duty is akin to the reporting that banks do. Additionally, any cash transactions above certain thresholds (e.g. €10,000) should be reported when required. Prompt reporting shields the gallery/auction house from liability and aids law enforcement in tracking illicit networks. To fulfill these obligations, art market participants should also appoint an AML compliance officer and train their staff on compliance procedures. Employees must be trained to spot red flags – such as a buyer refusing to provide information, insisting on paying in cash, or using an overly complex ownership structure for a purchase. Ultimately, a culture of compliance and ethical conduct is now an expected part of the art business. By conducting proper due diligence and documentation, galleries and auctioneers not only follow the law but also help protect the integrity of the art market. Operational and Reputational Risks of Non-Compliance Failing to comply with AML laws can be disastrous for an art business. The immediate risk is legal: authorities can impose hefty fines, revoke licenses, and even pursue criminal charges if a gallery or auction house is found complicit (even unwittingly) in money laundering. Under EU rules, those involved in laundering schemes can face prison sentences – 6AMLD mandates stricter penalties, including possible minimum prison terms for serious offenses. In some jurisdictions, individuals have been sentenced to years in jail for art-related money laundering conspiracies. Regulators are actively enforcing the new rules; for example, in the UK more than 30 art businesses were fined within two years of the 2020 law for failing to register or comply with AML requirements. The message is clear: non-compliance is not treated lightly. Beyond fines and legal sanctions, consider the reputational damage that comes with an AML scandal. The art world operates on trust and reputation. If a gallery becomes known as a hub for shady transactions, it risks losing the confidence of legitimate clients, banks, and partners. Reputation loss can lead to a swift downturn in business – collectors will shy away, fearful of being tainted by association. As experts note, rebuilding trust after such damage can take years. Moreover, employees may quit and talent may be harder to attract if the company’s name is sullied. In short, the cost of non-compliance far outweighs the investment needed to build a solid AML program. By contrast, those who comply demonstrate integrity and due care, which can become a competitive advantage in an increasingly transparency-conscious market. Automation: Supporting Safe and Transparent Transactions Keeping up with AML compliance can seem daunting, especially for smaller galleries and auction houses with limited staff. This is where automation and technology-driven solutions make a difference. By digitizing and streamlining compliance workflows, art businesses can meet regulatory requirements efficiently and accurately. In fact, regulators and industry groups encourage the use of technology to strengthen AML controls in the art trade. Here’s how automation supports compliance: Digital client onboarding: Instead of relying on paper forms and manual ID checks, galleries can use secure online platforms to onboard clients. Clients can submit identification documents electronically, which can be verified instantly using AI-powered tools or databases. This not only speeds up the process but also catches fake IDs or inconsistencies more reliably. A digital audit trail is created for each customer, showing exactly when and how their identity was verified – useful evidence of compliance. Automated screening and due diligence: Compliance software can automatically screen new clients against sanctions lists, PEP lists, and watchlists in real time. It can also pull in adverse media results on a client with a click. By automating these database checks, art businesses ensure no client is overlooked and that risk-relevant information (like a buyer’s political exposure or a negative news article) is surfaced immediately. Sophisticated platforms even assign a risk score to clients based on factors like country of origin, transaction size, and profile, guiding the business on when to apply enhanced due diligence. Transaction monitoring systems: For auction houses managing numerous sales, software can monitor transactions and flag patterns that might indicate money laundering. For example, splitting a large payment into smaller ones, or rapid resales of a high-value piece, would trigger alerts. Rules can be set to catch anomalies (e.g. a purchase far above the estimated value, or a client buying art inconsistent with their known wealth profile). Automated alerts allow compliance officers to investigate timely. This kind of continuous monitoring is difficult to achieve manually, but machines excel at scanning data for irregularities 24/7. Secure record-keeping: An AML software solution provides centralized record-keeping where all client due diligence files, risk assessments, and transaction records are stored securely. Instead of shuffling through filing cabinets, compliance staff can retrieve any record in seconds. Built-in retention schedules ensure you keep data as long as legally required. In the event of an audit or inspection, having well-organized digital records dramatically reduces the effort to demonstrate compliance. It also helps in maintaining consistency – for instance, ensuring every high-value sale has an ID on file and a recorded source of funds check. By leveraging automation in these ways, galleries and auctioneers can turn a compliance burden into a business strength. Technology reduces human error and frees up staff time, allowing compliance officers to focus on analyzing truly suspicious cases rather than getting bogged down in paperwork. It also gives owners peace of mind that nothing will “slip through the cracks” – the system will flag missing information or unusual behavior automatically. In an industry where regulations are evolving, an automated solution can be updated to keep pace with new rules, ensuring continuous compliance without constant retraining. AMLTrack – AML automation tailored for the art market AMLTrack is a compliance platform developed by TTMS in partnership with the law firm Sawaryn & Partners, designed to automate key anti-money laundering processes for obliged entities, including galleries and auction houses. The system streamlines client due diligence by verifying identities, checking customers against international sanctions and PEP lists, and retrieving data from official registers (such as KRS, CEIDG, and CRBR in Poland). It also supports risk assessment, generates compliance reports, and securely archives all actions to ensure full audit readiness. By minimizing human error and reducing the burden of manual checks, AMLTrack enables art market participants to meet EU AML requirements more efficiently, safeguard their reputation, and protect their businesses from regulatory penalties. Ultimately, embracing digital AML tools helps art businesses fulfill the dual mandate of safety and transparency. It reassures clients that your gallery or auction house is a reputable, law-abiding place to do business, while making it far harder for criminals to exploit your platform. As the EU’s AML directives have shown, the era of art market opacity is ending. Galleries and auction houses that invest in compliance – and smart automation – are not only avoiding penalties, they are protecting their reputation and contributing to a cleaner, more transparent art market for all. Do all galleries and auction houses in the EU need to comply with AML regulations? Yes. Under the EU’s 5th Anti-Money Laundering Directive (5AMLD), all galleries, auction houses, and art dealers involved in transactions exceeding €10,000 must implement comprehensive AML procedures. This requirement applies to individual sales as well as multiple linked transactions totaling that amount or more. What specific AML obligations do art market businesses have under EU law? Art businesses must carry out client due diligence (CDD), verify the identity of buyers and beneficial owners, screen clients against sanctions and politically exposed persons (PEP) lists, monitor transactions for suspicious activity, maintain detailed records, and report suspicious transactions to financial authorities. What makes the art market particularly attractive for money laundering? The art market offers a combination of high-value assets, portability, privacy, and subjective valuation—ideal conditions for concealing and transferring illicit funds. Historically limited regulatory oversight and opaque transactions have further attracted criminals looking to legitimize illegal wealth. Can AML automation really help smaller galleries comply with EU regulations? Yes. Automation significantly simplifies compliance processes for galleries and auction houses of all sizes. Digital tools streamline client onboarding, automate identity checks, continuously monitor transactions, and ensure robust record-keeping, helping even small businesses meet complex regulatory requirements without needing extensive compliance teams. What happens if an art gallery or auction house does not comply with AML regulations? Non-compliance with AML rules can result in severe financial penalties, legal sanctions, and potentially criminal charges under EU laws like 6AMLD. Beyond legal consequences, businesses risk serious reputational damage, loss of client trust, reduced market opportunities, and difficulties restoring their standing within the art community.

Read moreAML Risks in Real Estate: How Automation Helps Reduce Exposure