KYC as the Foundation of AML Compliance – Role in Preventing Financial Crime and Requirements of 5AMLD/6AMLD

KYC (Know Your Customer) is the process of verifying the identity and credibility of clients, which forms the basis of compliance with AML (Anti-Money Laundering) regulations. Thanks to an effective KYC process, financial institutions and other businesses can ensure who they are entering into relationships with, preventing their services from being misused for financial crime such as money laundering or terrorism financing. EU regulations – including the 5th and 6th AML Directives (5AMLD, 6AMLD) – require companies to implement solid KYC procedures as part of their broader AML program. This article explains the importance of the KYC process as the foundation of AML compliance, its role in preventing financial crime, its connection to EU regulations (5AMLD, 6AMLD), and the requirements imposed on companies in the EU. It is aimed at business audiences – banks, financial institutions, real estate firms, law firms, accounting offices, and other obligated entities – who want to understand how to implement an effective KYC process and integrate it with AML solutions.

What is the KYC Process and Why Is It Crucial?

The KYC process is a set of procedures designed to thoroughly know the customer. It includes identifying and verifying the client’s identity using independent and reliable documents and information, as well as assessing the risks associated with the business relationship. In other words, a company checks who the client is, where their funds come from, and the purpose of the relationship. KYC is essential because it prevents serving anonymous clients or those using false identities and helps detect potentially suspicious circumstances already at the onboarding stage.

The KYC process is considered the foundation of AML compliance, as without proper client identification further anti-money laundering activities would be ineffective. Adhering to KYC procedures enables, among other things, establishing the true identity of the customer, learning the source of their funds, and assessing the level of risk, thus forming the first line of defense against the misuse of a company for criminal purposes. Companies that implement effective KYC better protect their reputation and avoid engaging with clients who carry unacceptable risk.

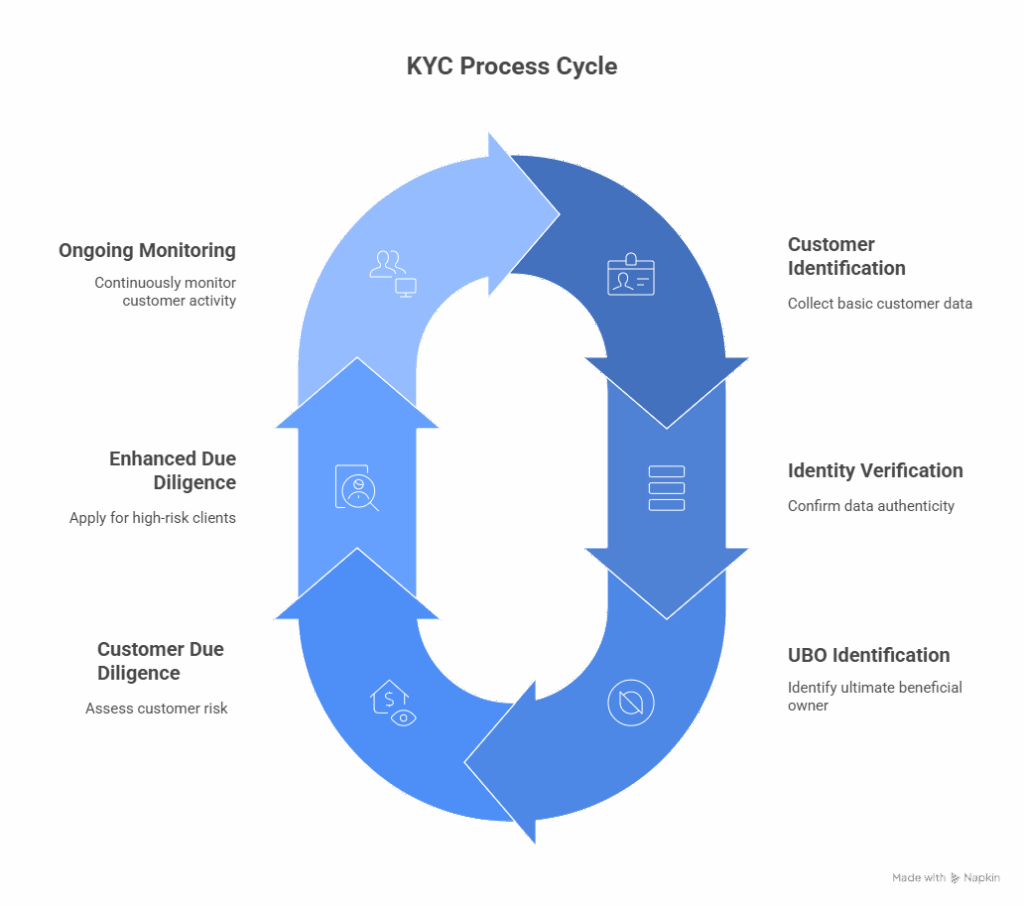

Key elements of the KYC process include, among others:

- Customer Identification (CIP) – collecting the customer’s basic personal data (e.g., name, address, date of birth, national ID or tax number in the case of a company) and copies of identity and registration documents as the first step in establishing the relationship.

- Identity Verification – confirming the authenticity of collected data using documents (ID card, passport), public registers, or other independent sources. Modern e-KYC tools are often used, such as biometric verification of documents and facial recognition, to quickly and accurately verify the client.

- Ultimate Beneficial Ownership (UBO) – identifying the natural person who ultimately controls a client that is a legal entity. This requires determining the ownership structure and often consulting registers such as the Central Register of Beneficial Owners.

- Customer Due Diligence (CDD) – analyzing and assessing customer risk based on the information collected. This includes checking whether the client appears on sanctions lists or is a politically exposed person (PEP), as well as understanding the client’s business profile and the purpose and nature of the relationship. Standard CDD applies to most customers with a typical risk profile.

- Enhanced Due Diligence (EDD) – in-depth verification for high-risk clients. If a client is deemed high risk (e.g., a foreign politician, operating in a high-risk country, or carrying out very large transactions), the institution must apply enhanced security measures: request additional documentation, monitor transactions more frequently, and obtain senior management approval to establish or maintain the relationship.

- Ongoing Monitoring – the KYC process does not end once the client has been onboarded. It is crucial to continuously monitor customer activity and transactions to detect potential suspicious actions. This includes regular updates of client information (periodic refresh of KYC data), analyzing transactions for consistency with the customer’s profile, and reacting to red flags (e.g., unusually large cash deposits).

All of the above elements make up a comprehensive “Know Your Customer” process, which is the cornerstone of secure business operations. Best practices require documenting all KYC activities and retaining the collected data for the legally mandated period (usually 5 years or more). This allows the institution to demonstrate to regulators that it fulfills its KYC/AML obligations and properly manages customer risk.

The Role of KYC in Preventing Financial Crime

Strong KYC procedures are essential for preventing financial crime. By thoroughly knowing the customer, companies can identify red flags pointing to potential money laundering, terrorism financing, or fraud at an early stage. For example, verifying the client’s identity and source of funds may reveal that the person appears in suspect registers or originates from a sanctioned country – requiring enhanced scrutiny or refusal of cooperation.

KYC provides critical input data to AML systems. Information gathered about the customer (e.g., identification data, PEP status, transaction profile) feeds analytical engines and transaction monitoring systems. This enables automated comparison of the customer’s behavior against their expected risk profile. If the customer begins conducting unusual operations – for example, significantly larger transactions than usual or transfers to high-risk jurisdictions – the AML system will detect anomalies based on KYC data and generate an alert. In this way, KYC and AML work together to prevent illegal financial activities.

Good KYC increases the effectiveness of transaction monitoring and makes it easier to identify truly suspicious activities, while at the same time reducing the number of false alerts.

In addition, fulfilling KYC obligations deters potential criminals. A financial institution that requires full identification and verification becomes less attractive to those attempting to launder money. From a company’s perspective, effective KYC not only prevents fines and financial losses associated with (even unintentional) involvement in criminal activity, but also protects its reputation. In sectors such as banking or real estate, trust is key – and implementing high KYC standards builds the institution’s credibility in the eyes of both clients and regulators.

EU AML Regulations: 5AMLD, 6AMLD and KYC Obligations for Companies

The European Union has developed a comprehensive set of AML/KYC regulations designed to harmonize and strengthen the fight against money laundering across all Member States. The main legal acts are successive AML Directives: 4AMLD, 5AMLD and 6AMLD (the fourth, fifth and sixth Anti-Money Laundering Directives). These directives have been transposed into national law (in Poland through the Act of March 1, 2018 on Counteracting Money Laundering and Terrorist Financing) and impose on obligated institutions a range of requirements related to KYC and AML.

Obligated institutions include all entities operating in sectors particularly exposed to the risk of money laundering. These cover not only banks and investment firms, but also insurers, brokerage houses, payment institutions, and currency exchange offices, as well as non-financial entities – such as notaries, lawyers (when handling clients’ financial transactions), tax advisors, accounting offices, real estate brokers, auction houses and art galleries (selling luxury goods), cryptocurrency exchanges, and lending companies. All of these entities are legally required to apply KYC and AML procedures. They must implement internal policies and procedures that ensure customer identification, risk assessment, transaction registration and reporting, as well as staff training on AML regulations.

5th AML Directive (5AMLD), effective from January 2020, introduced significant extensions to KYC obligations. Among other things, the list of obligated institutions was expanded – for the first time including cryptocurrency exchanges and wallet providers, who are now required to conduct full KYC on their users and report suspicious operations. 5AMLD also emphasized greater transparency of company ownership information by mandating public access to registers of beneficial owners of companies in the EU, making it easier for institutions to access ownership data of corporate clients. Additional security measures were introduced for transactions with high-risk countries, and thresholds for certain transactions requiring KYC were lowered (e.g., for occasional transactions involving virtual currencies, the threshold was set at EUR 1000). For financial institutions and other firms, this meant updating KYC/AML procedures – adapting them to cover new types of clients and transactions, and to use new registers.

6th AML Directive (6AMLD), transposed by Member States by December 2020, focuses on harmonizing definitions of money laundering offenses and tightening sanctions.

It introduced a common EU-wide list of 22 predicate offences, the commission of which is considered the source of “dirty money” subject to money laundering. Among these offences, cybercrime was added for the first time in EU AML regulations. 6AMLD required EU countries to introduce laws providing harsher penalties for money laundering – across the Union, the minimum maximum prison sentence for this crime must be at least 4 years. Another important element of 6AMLD is the extension of criminal liability to legal entities (companies). A business can be held liable if, for example, its management allows money laundering to occur within the company’s operations or fails to meet oversight obligations. In practice, 6AMLD forces companies to take even greater care with compliance – lapses in AML controls can result in severe legal consequences not only for employees but also for the organization itself.

The EU directives translate into specific KYC/AML requirements for companies. Every obligated institution in the EU must apply so-called customer due diligence measures, which include: identification and verification of the customer and beneficial owner, assessment of the purpose and nature of the business relationship, ongoing monitoring of customer transactions, and retaining collected information for at least 5 years. For high-risk clients, enhanced due diligence (EDD) is required, such as obtaining additional information on the sources of wealth or closer monitoring of transactions. Companies must also maintain a register of transactions above defined thresholds and report suspicious transactions to the competent authorities (e.g., in Poland, to GIIF). In addition, regulations require companies to appoint an AML Officer responsible for oversight and to regularly train staff on current AML rules.

Failure to comply with KYC/AML obligations carries serious sanctions. Regulators may impose high administrative fines – up to 5 million euros or 10% of annual company turnover for severe violations. They may also apply other measures such as a temporary ban on conducting certain activities or public disclosure of the violation, exposing the firm to major reputational damage. In addition, individuals (e.g., management board members) may face criminal liability – in Poland, money laundering is punishable by up to 12 years of imprisonment. All this means that adhering to AML regulations and diligently carrying out the KYC process is not just a legal duty, but a matter of business survival and security.

Implementing an Effective KYC Process and Integration with AML Solutions

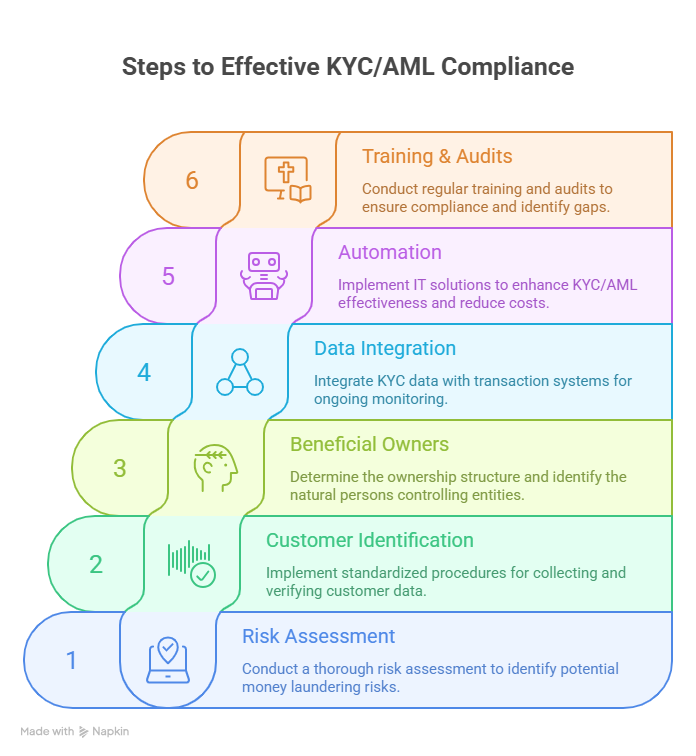

To meet legal requirements and genuinely reduce risk, companies must not only formally implement KYC procedures but do so effectively and integrate them with the overall AML system. Below are the key steps and best practices for building an effective KYC process and linking it to broader AML activities:

- Risk assessment and AML/KYC policy: An organization should begin with a risk assessment of money laundering related to its activities and types of clients. Based on this, it develops an internal AML/KYC policy defining customer identification procedures, division of responsibilities, incident reporting, etc. A risk-based approach ensures resources are directed where risk is highest – e.g., stricter procedures for clients from high-risk countries or sectors.

- Customer identification and verification procedures: The company should implement standardized procedures for collecting and verifying data from new clients. Increasingly, digital solutions streamline KYC – for example, remote identity verification apps using document scanning and biometric facial verification. It is also important to check clients in available registers and databases, such as EU/UN sanctions lists and PEP databases, which can be automated using specialized software.

- Identifying beneficial owners in corporate clients: For business or organizational clients, it is essential to determine their ownership structure and identify the natural persons who ultimately control the entity (UBOs). Central registers of beneficial owners (such as CRBR in Poland) can help, but under 5AMLD institutions cannot rely solely on these registers – they should independently verify information and document any difficulties in identifying the owner.

- Integrating KYC data with transaction systems: All customer information obtained during KYC should be used in ongoing monitoring. Ideally, the company’s banking or financial system should be integrated with an AML module so that the client’s risk profile influences transaction monitoring. For example, a high-risk client will be subject to more frequent and detailed analysis. KYC data feeds AML scoring engines, enabling automatic detection of unusual behavior and faster response. Such integration also reduces data silos and the risk of overlooking important client information.

- Automation and modern technologies: Implementing dedicated IT solutions can significantly increase effectiveness and reduce the costs of KYC/AML. For example, AI-based systems can analyze customer behavior and transactions in real time, while machine learning helps detect unnatural patterns that may indicate money laundering. Robotic Process Automation (RPA) is used to automatically extract and verify data from documents (OCR), reducing human error. Research shows that automation and KYC/AML integration can shorten new customer verification time by up to 80% and drastically cut errors. As a result, compliance improves while customer onboarding becomes faster and less burdensome.

- Training and compliance audits: Technology alone cannot replace human factors. Staff must be properly trained in KYC/AML procedures and know how to recognize warning signs. Companies should regularly conduct training for frontline employees and management, and also perform periodic internal compliance audits. Audits help identify gaps or irregularities in fulfilling KYC/AML obligations and implement corrective actions before an external regulator’s inspection.

In summary, effective implementation of the KYC process requires a combination of people, procedures, and technology. Obligated institutions should treat KYC not as a burden, but as an investment in the security of their business. An integrated KYC/AML process ensures compliance with regulations, early detection of abuse attempts, increased operational efficiency, and trust-building with clients and business partners. In the dynamic EU regulatory environment (with further changes underway, including the establishment of a pan-European AML authority – AMLA), companies must continuously refine their KYC/AML procedures to stay ahead of financial criminals and meet growing supervisory demands.

Most Common Questions about KYC/AML (FAQ)

What is the KYC process and what is its purpose?

The KYC (Know Your Customer) process is a set of procedures aimed at knowing and verifying the customer’s identity. Its purpose is to confirm that the client is who they claim to be and to understand the risks associated with serving them. As part of KYC, the institution collects personal data and documents (e.g., ID card, company registration documents), verifies their authenticity, and assesses the client’s profile (including sources of funds, type of business activity). The goal of KYC is to protect the company from engaging with imposters, dishonest clients, or those involved in money laundering or terrorism financing.

In short – thanks to KYC, a company knows who it is dealing with and can consciously manage the associated risks.

How is KYC different from AML?

KYC and AML are related but distinct concepts. KYC focuses on knowing the customer – it is the process of identifying and verifying client data and assessing risk before and during the business relationship. AML (Anti-Money Laundering), on the other hand, is a broader system of regulations, procedures, and actions aimed at preventing money laundering and terrorist financing across the organization as a whole. In other words, KYC is one element of the overall AML program. In practice, AML includes not only the initial verification of the customer (KYC), but also ongoing transaction monitoring, behavioral analysis, detection of suspicious patterns, and reporting of suspicious transactions to the relevant authorities. KYC provides the input – knowledge of who the customer is and their characteristics – while the AML system uses this data for comprehensive oversight of financial activity after the relationship has begun. Both elements must work closely together: even the best AML transaction monitoring tools will not function effectively if the company knows nothing about its clientele (lack of KYC), and conversely – KYC alone without subsequent monitoring will not be enough to detect unusual transactions conducted by an apparently “normal” client.

Which EU regulations govern KYC/AML obligations (5AMLD, 6AMLD)?

In the European Union, the legal framework for KYC/AML obligations is set out in successive AML directives. 4AMLD (Directive 2015/849) introduced the risk-based approach and the requirement to create central registers of beneficial owners of companies. 5AMLD (Directive 2018/843) expanded the scope of regulation – bringing crypto exchanges and wallet providers into the AML regime, placing greater emphasis on beneficial ownership identification (including public access to UBO registers), and tightening rules for cooperation with high-risk countries. 6AMLD (Directive 2018/1673) harmonized definitions of money laundering offenses across the EU and strengthened criminal aspects – it identified 22 predicate offenses, introduced stricter minimum penalties (Member States must provide at least 4 years maximum imprisonment for money laundering), and extended criminal liability to legal entities. In practice, this means that companies in the EU must comply with uniform standards for client identification, verifying their status (e.g., whether they are on a sanctions list), and monitoring transactions. National laws (such as Poland’s AML Act) implement these directives by imposing specific obligations on obligated institutions: applying customer due diligence in defined scenarios, reporting suspicious and above-threshold transactions, retaining documentation, appointing an internal AML Officer, etc. Furthermore, EU regulations are continuously evolving – in 2024, the AML package was agreed, which includes the establishment of an EU-wide AML authority (AMLA) and the introduction of a new AML regulation, further unifying the approach to KYC/AML across the Union.

Which companies are subject to KYC/AML obligations?

KYC and AML obligations apply to so-called obligated institutions, entities designated by law as particularly exposed to the risk of money laundering or terrorist financing. The list is broad. It traditionally includes all financial institutions: banks (including foreign branches), credit unions, brokerage houses, insurance companies (especially life insurers), investment funds, payment institutions, and currency exchange offices. In addition, AML obligations also apply to notaries, lawyers (when handling clients’ financial transactions such as property deals or company formation), tax advisors, auditors, and accounting offices. The catalog of obligated institutions also includes real estate agents, businesses dealing in luxury goods (e.g., antiques, works of art, precious stones – if transactions exceed a set threshold), and, since 5AMLD, crypto exchanges and wallet providers. As a result, the duty to implement KYC/AML procedures rests on a very wide range of companies – not only banks. Each of these institutions must identify their clients, monitor their transactions, and report suspicions to state authorities. It is worth noting that even companies outside the official list of obligated institutions often voluntarily adopt KYC/AML measures (e.g., fintechs not under full supervision), as this is seen as good business practice and a way to build customer trust.

How to effectively implement KYC in a company and integrate it with AML?

Implementing an effective KYC process requires a multi-layered approach – combining clearly defined procedures, trained personnel, and the right technological tools. Here are a few steps and principles to achieve this goal:

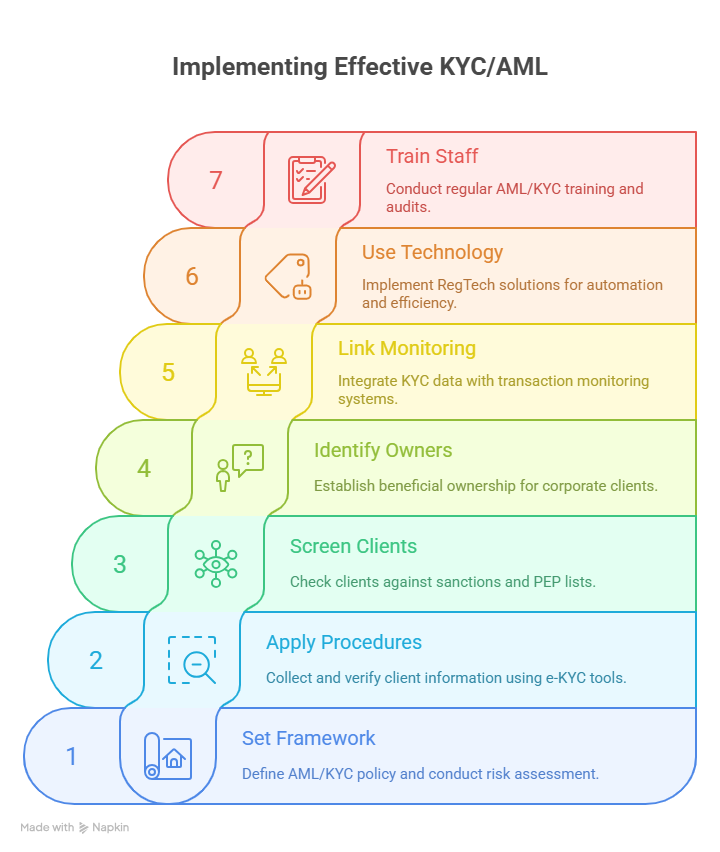

1. Set the framework and risk assessment: Begin by defining an AML/KYC policy tailored to the company’s profile. It should state when KYC measures must be applied (e.g., at the start of every client relationship or for transactions above a certain threshold) and who is responsible. At the same time, conduct a risk assessment to identify business areas and client types most vulnerable to money laundering. The results help focus attention where risk is highest.

2. Apply appropriate identification procedures: Collecting complete information from the client and verifying its authenticity is crucial. Prepare lists of acceptable identity and registration documents and establish verification procedures. Increasingly, remote verification tools (e-KYC) are used, such as automatic reading of ID data and comparing the photo in the document with the client’s live facial image. These technologies speed up the process and reduce human error.

3. Screen clients against external databases: A key part of KYC is checking whether the client appears on international sanctions lists or in PEP databases. Manual searching is inefficient – it is better to use screening systems that automatically compare client data against constantly updated lists. This way, the company immediately knows if a prospective client is sanctioned or holds a prominent public function, requiring additional measures (EDD).

4. Identify beneficial owners: For corporate clients, you must establish who ultimately owns and controls the entity. Obtain current extracts from registers (e.g., national company registers) and use beneficial ownership registers to understand the ownership structure. For complex ownership (e.g., subsidiaries of foreign holdings), request organizational charts or declarations. Record every step – regulations require documenting difficulties in identifying UBOs.

5. Link KYC with transaction monitoring: The data collected during KYC should be used in ongoing monitoring. A client’s risk profile should influence transaction monitoring parameters. Modern AML systems define detection scenarios using KYC data (e.g., different thresholds for low-risk vs. high-risk clients). Ensuring automatic, real-time integration between KYC databases and transaction systems is critical. This integration allows anomalies to be detected more quickly and improves the effectiveness of the entire AML program.

6. Use technology and automation: Investing in RegTech solutions improves efficiency. For example, AML platforms can score risk automatically using KYC data, and AI-based systems can analyze transactions in real time, learning normal behavior patterns and generating alerts for anomalies. Automation reduces manual work like retyping data (OCR handles it) or creating reports. Studies show that RegTech solutions can cut onboarding time by up to 80% and reduce errors and false positives, letting compliance staff focus on truly suspicious cases.

7. Train staff and ensure compliance audits: Even the best procedures will fail if people do not follow them or do not understand their purpose. Regular AML/KYC training is mandatory – both at onboarding new employees and periodically (e.g., annually) for all staff. Training reinforces the ability to spot suspicious activity and respond properly. Management should also ensure independent internal audits of AML/KYC procedures to verify compliance, documentation completeness, and system effectiveness. Audit results enable corrective actions before regulators uncover issues.

Implementing an effective KYC process is continuous, not a one-off project. AML regulations evolve, new risks (e.g., from cryptocurrencies or emerging fintech) appear, so companies must continuously adapt. Still, investing in robust KYC/AML processes brings multiple benefits – avoiding fines, protecting reputation, and creating a transparent, secure business environment that supports long-term growth.

What are the most common mistakes companies make when implementing KYC?

One of the most common mistakes is approaching KYC as a one-off obligation rather than a continuous process. Organizations often fail to update client information, rely too much on manual checks instead of using automation, or overlook the importance of training employees. These shortcomings create compliance risks and reduce the effectiveness of the entire AML framework.

How does KYC affect the customer experience?

When properly implemented, KYC can actually improve customer experience. Automated e-KYC tools allow customers to go through onboarding faster and with fewer documents, often in a fully digital process. Clear communication and user-friendly design help reduce frustration, while strong verification builds trust and confidence in the institution.

Is KYC only relevant for the financial sector?

KYC obligations extend far beyond traditional banks and insurers. Real estate agencies, law firms, accounting offices, luxury goods dealers, art galleries, casinos, and cryptocurrency exchanges are also required to conduct KYC under EU directives. Even companies outside the formal list of obligated entities increasingly adopt KYC voluntarily to safeguard their reputation and business relationships.

How is automation changing the KYC process?

Automation has become a game changer for KYC. Artificial intelligence, RegTech, and robotic process automation allow firms to handle large volumes of customer data more efficiently. Automated sanctions screening, biometric ID verification, and real-time monitoring reduce errors and free up compliance teams to focus on genuinely suspicious cases.

What does the future of KYC look like beyond 2025?

KYC is expected to integrate with digital identity initiatives across the EU, making verification faster and more secure. Technologies such as blockchain analytics, biometric authentication, and cross-border data sharing will become standard. With the creation of the EU AML Authority (AMLA), supervision will become more centralized and harmonized, ensuring higher consistency and stricter enforcement across Member States.