Software development timelines that stretch for months no longer match the pace of modern business. Organizations need applications deployed in weeks, not quarters, while maintaining quality and security standards. Low-code development addresses this challenge by transforming how companies build and deploy digital solutions, making application creation accessible to broader teams while accelerating delivery cycles.

87% of enterprise developers now use low-code platforms for at least some work, reflecting widespread adoption amid talent shortages. The shift represents more than technical shortcuts. These principles establish a framework for sustainable development that balances speed with governance, empowers business users while maintaining IT control, and scales individual projects into enterprise-wide transformation.

TTMS has implemented low-code solutions across diverse industries, specializing in platforms like PowerApps and WebCon. Success depends less on platform features and more on adherence to fundamental principles that guide development decisions, governance structures, and organizational adoption strategies.

1. What Makes Low-Code Development Principles Essential

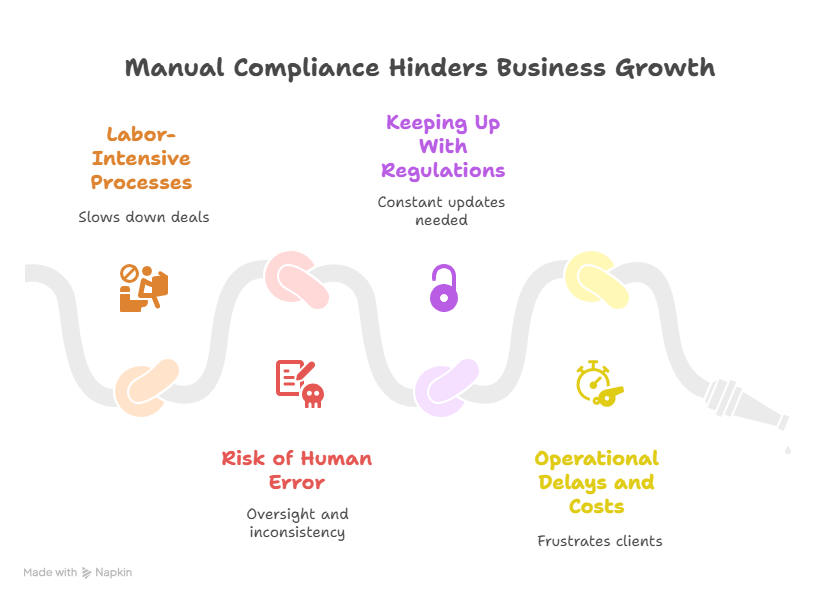

Digital transformation initiatives face a persistent challenge: the gap between business needs and technical capacity continues widening. Traditional development approaches require specialized programming knowledge, lengthy development cycles, and significant resources. This creates bottlenecks that slow innovation and frustrate business teams waiting for IT departments to address their requirements.

Low-code platforms reduce development time by up to 90% compared to traditional methods, fundamentally reshaping this dynamic. Organizations can respond faster to market changes, experiment with new solutions at lower cost, and involve business stakeholders directly in building the tools they need. The market reflects this value: Gartner predicts the low-code market will reach $16.5 billion by 2027, with 80% of users outside IT by 2026.

Yet 41% of business leaders find low-code platforms more complicated to implement and maintain than initially expected. The principles of low code create guardrails that prevent the chaos of uncontrolled application sprawl. Without these guidelines, organizations risk security vulnerabilities, compliance failures, and unsustainable application portfolios.

Business agility increasingly determines competitive advantage. 61% of low-code users deliver custom apps on time, on scope, and within budget. Companies that rapidly prototype, test, and deploy solutions gain market position, but only when organizations apply core principles consistently across their development initiatives.

2. Core Principles of Low-Code Development

2.1 Visual-First Development

Visual interfaces replace code syntax as the primary development medium. Developers and business users arrange pre-built components, define logic through flowcharts, and configure functionality through property panels rather than writing lines of code. This approach reduces cognitive load and makes application structure immediately visible to technical and non-technical team members alike.

PowerApps embodies visual-first development through its canvas and model-driven app builders. Users drag form controls, connect data sources, and define business logic through visual expressions. A sales manager can build a customer relationship tracking app by arranging galleries, input forms, and charts on a canvas, connecting each element to data sources through dropdown menus and simple formulas.

WebCon takes this principle into workflow automation, where business processes appear as visual flowcharts. Each step in an approval process, document routing system, or quality control workflow appears as a node that users configure through forms rather than code. The visual approach accelerates learning curves significantly. New team members understand existing applications by examining their visual structure rather than reading through code files.

2.2 Component Reusability and Modularity

Building applications from reusable components accelerates development while ensuring consistency. Instead of creating every element from scratch, developers assemble applications from pre-built components that encapsulate specific functionality.

PowerApps component libraries enable teams to create custom controls that appear across multiple applications. An organization might develop a standardized address input component that includes validation, postal code lookup, and formatting. Every app requiring address entry uses this identical component, ensuring consistent user experience and data quality. Updates to the component automatically propagate to all applications using it.

WebCon’s process template library demonstrates modularity at the workflow level. Common approval patterns, document routing logic, and notification sequences become reusable templates. When building a new purchase requisition process, developers start with a standard approval template rather than configuring each step manually.

This reusability extends to entire application patterns. Organizations identify recurring needs across departments and create solution templates that address these patterns. Customer feedback collection, equipment maintenance requests, and expense approvals share similar structures. Templates capturing these patterns reduce development time from weeks to days.

2.3 Rapid Iteration and Prototyping

Low-code enables development cycles measured in days rather than months. Teams quickly build working prototypes, gather user feedback, and implement improvements in tight iteration loops. This agile approach reduces risk by validating assumptions early and ensures final applications closely match actual user needs.

An unnamed field inspection company faced days-long response times to safety issues due to handwritten forms. They built a PowerApp for mobile inspections with digital forms, photo capture, GPS tagging, and instant SharePoint routing with notifications for critical issues. Response times dropped from days to minutes, with 15+ hours saved weekly organization-wide while improving OSHA compliance and reducing liability.

WebCon’s visual workflow builder accelerates process iteration similarly. Business analysts create initial workflow versions, stakeholders test them with sample cases, and the team refines logic based on real behavior. This experimentation identifies bottlenecks, unnecessary approval steps, and missing notifications before processes impact actual operations.

Rapid iteration transforms failure into learning. Teams can test unconventional approaches, knowing that failed experiments cost days rather than months.

2.4 Citizen Developer Enablement with IT Oversight

Low-code empowers business users to create applications while maintaining IT governance. Citizen developers bring domain expertise and immediate understanding of business problems but may lack technical knowledge of security, integration, and scalability considerations. Balancing this empowerment with appropriate oversight prevents issues while capturing the innovation citizen developers provide.

PowerApps establishes this balance through environment management and data loss prevention policies. IT teams create development environments where citizen developers build applications with access to approved data sources and connectors. Before applications move to production, IT reviews them for security compliance, data governance adherence, and architectural soundness.

Aon Brazil CRS, part of a global insurance brokerage, managed complex claims workflows with poor visibility and manual tracking. Incoming cases lacked automatic assignment and real-time resolution tracking. They developed an SLS app using PowerApps to auto-capture cases, assign to teams, and track metrics in real-time. The result: improved team productivity, better capacity planning, cost management, and comprehensive case load visibility per team member.

Organizations implementing WebCon typically establish Centers of Excellence that support citizen developers with training, templates, and consultation. A finance department citizen developer building an invoice approval workflow receives guidance on integration with accounting systems, compliance requirements for financial records, and best practices for workflow design.

2.5 Model-Driven Architecture

Model-driven development shifts focus from implementation details to business logic and data relationships. Developers define what applications should accomplish rather than specifying how to accomplish it. The low-code platform translates these high-level models into functioning applications, handling technical implementation automatically.

PowerApps model-driven apps demonstrate this principle through their foundation on Microsoft Dataverse. Developers define business entities (customers, orders, products), relationships between entities, and business rules governing data behavior. The platform automatically generates forms, views, and business logic based on these definitions. Changes to the data model immediately reflect across all application components without manual updates to each interface element.

This abstraction simplifies maintenance significantly. When business requirements change, developers update the underlying model rather than modifying multiple code files. Adding a new field to customer records requires defining the field once in the data model, with the platform automatically including it in relevant forms and views.

WebCon applies model-driven principles to workflow automation. Developers define the business states a process moves through (submitted, under review, approved, rejected) and rules governing transitions between states. The platform generates the user interface, notification systems, and data tracking automatically.

2.6 Integration-First Design

Modern applications rarely function in isolation. They need data from enterprise resource planning systems, customer relationship management platforms, financial software, and numerous other sources. Low-code platforms prioritize integration capabilities, treating connectivity as a fundamental feature rather than an afterthought.

PowerApps includes hundreds of pre-built connectors to common business systems, cloud services, and data sources. Building an application that pulls customer data from Salesforce, retrieves product inventory from an ERP system, and sends notifications through Microsoft Teams requires no custom integration code. Developers simply add connectors and configure data flows through visual interfaces.

WebCon’s REST API and integration framework enable similar connectivity for workflow automation. Purchase approval processes pull budget data from financial systems, inventory requisitions check stock levels in warehouse management software, and completed workflows update records in enterprise applications.

In a recent healthcare implementation, TTMS integrated PowerApps with three legacy systems (Epic EHR, proprietary billing system, and SQL Server database) to create a patient referral tracking system. The solution reduced referral processing time from 6 days to 8 hours by automating data validation, eliminating manual re-entry across systems, and triggering real-time notifications when referrals stalled. The integration layer handled HIPAA compliance requirements while maintaining existing system security policies.

2.7 Collaboration Across Technical and Business Teams

Successful low-code implementation requires breaking down traditional barriers between business and IT departments. Visual development tools create a shared language that both groups understand, enabling collaborative design sessions where business experts and technical teams jointly build solutions.

PowerApps supports collaborative development through co-authoring features and shared component libraries. Business analysts can design user interfaces and define basic logic while developers handle complex integrations and performance optimization. This parallel work accelerates development while ensuring applications meet both functional and technical requirements.

Microsoft’s HR team struggled with HR processes lacking rich UI for user experience across its 100,000+ employee workforce. After evaluating options, the HR team selected PowerApps, refining solutions with Microsoft IT to deploy a suite of “Thrive” apps integrated with the Power Platform. The deployment resulted in efficient hiring, better employee engagement, enhanced collaboration, and data-driven HR decisions.

WebCon workflows benefit particularly from cross-functional collaboration. Process owners understand business requirements and approval hierarchies while IT staff know system integration points and security requirements. Collaborative workshops using WebCon’s visual workflow designer allow both groups to contribute their expertise directly, resulting in processes that work technically and align with business reality.

2.8 Scalability and Performance from the Start

Applications beginning as departmental tools often grow into enterprise-wide systems. Low-code principles emphasize building scalability into initial designs rather than treating it as a future concern. This forward-looking approach prevents costly rewrites when applications succeed beyond original expectations.

PowerApps architecture includes built-in scalability through its cloud infrastructure and connection to Azure services. An app starting with 50 users in a single department can expand to thousands across multiple regions without architectural changes. Performance optimization techniques like data delegation and proper connector usage ensure applications maintain responsiveness as usage grows.

WebCon workflows scale through their underlying SQL Server foundation and distributed processing capabilities. A document approval process handling dozens of transactions daily can grow to thousands without degradation. Proper workflow design, including efficient database queries and appropriate caching strategies, maintains performance across usage scales.

Through 50+ PowerApps implementations, TTMS found that applications exceeding 50 screens typically benefit from model-driven approach rather than canvas apps, despite longer initial setup. This architectural decision, made early in development, prevents performance bottlenecks and maintainability issues as applications expand. One manufacturing client avoided complete application rebuild by implementing this pattern from the start, allowing their inventory management app to expand from a single warehouse to 15 locations within six months.

2.9 Security and Compliance by Design

Low-code platforms must embed security and compliance controls throughout development rather than adding them as final steps. This built-in approach prevents vulnerabilities and ensures applications meet regulatory requirements from their first deployment.

PowerApps integrates with Microsoft’s security framework, applying Azure Active Directory authentication, role-based access controls, and data loss prevention policies automatically. Developers configure security through permission settings rather than writing authentication code. Compliance features like audit logging and data encryption activate through platform settings, ensuring consistent security across all applications.

WebCon workflows incorporate approval chains, audit trails, and document security that meet requirements for industries like healthcare, finance, and manufacturing. Every process step records who performed actions, when they occurred, and what changes were made. This transparency satisfies regulatory audits while providing operational visibility.

When WebCon workflow response times exceeded 30 seconds for complex approval chains, TTMS implemented asynchronous processing patterns that reduced response time to under 2 seconds while maintaining audit trail integrity. The solution involved restructuring workflow logic to handle heavy processing off the main approval path, queuing notifications for batch delivery, and optimizing database queries that checked approval authority across multiple organizational hierarchies. This technical refinement maintained security and compliance requirements while dramatically improving user experience.

2.10 AI-Augmented Development

Artificial intelligence increasingly assists low-code development through intelligent suggestions, automated testing, and natural language interfaces. This augmentation accelerates development while helping less experienced builders follow best practices.

PowerApps incorporates AI through features like formula suggestions, component recommendations, and natural language to formula conversion. Developers typing a formula receive intelligent suggestions based on context and common patterns. Describing desired functionality in natural language can generate appropriate formulas automatically, reducing the technical knowledge required for complex logic.

TTMS combines its AI implementation expertise with low-code development, creating solutions that incorporate machine learning models within PowerApps interfaces. A predictive maintenance application uses Azure Machine Learning models to forecast equipment failures while presenting results through an intuitive PowerApps dashboard, enabling maintenance teams to prioritize interventions based on AI-generated risk scores integrated with real-time sensor data.

3. How to Implement Low-Code Principles Successfully

Understanding principles matters little without effective implementation strategies. Organizations must translate these concepts into practical governance structures, support systems, and adoption approaches that work within their specific contexts.

3.1 Establish Clear Governance Frameworks

Governance frameworks define who can build what applications, where they can deploy them, and what standards they must follow. 43% of enterprises report implementation and maintenance are too complex, with 42% citing complexity as a primary challenge. Without governance structures, low-code initiatives risk creating unmanaged application sprawl, security vulnerabilities, and technical debt.

Effective governance categorizes applications by risk and complexity. Simple productivity tools might proceed with minimal oversight, while applications handling sensitive data require architectural review and security approval. PowerApps environments help enforce these distinctions by separating development, testing, and production deployments with appropriate access controls between them.

WebCon implementations benefit from process governance that defines workflow standards, naming conventions, and integration patterns. A governance document might specify that all financial workflows must include specific approval steps, maintain audit trails for seven years, and integrate with the general ledger system through approved APIs.

TTMS helps clients develop governance frameworks matching their organizational culture and risk tolerance. A startup might accept more citizen developer autonomy with lighter oversight, while a financial services firm requires rigorous controls and IT review.

3.2 Build a Center of Excellence

Centers of Excellence provide centralized support, training, and standards that accelerate low-code adoption while maintaining quality. These teams typically include experienced developers, business analysts, and change management specialists who guide organizational low-code initiatives.

A low-code Center of Excellence offers multiple functions: developing reusable components and templates, providing training to citizen developers, reviewing applications before production deployment, and maintaining documentation of standards and best practices. For PowerApps implementations, the CoE might maintain component libraries, conduct regular training sessions, and offer consultation on complex integrations.

WebCon Centers of Excellence focus on workflow optimization, template development, and integration architecture. They help departments identify automation opportunities, design efficient processes, and implement solutions following organizational standards.

Organizations starting low-code initiatives should establish Centers of Excellence early, even if initially staffed by just two or three people. As adoption grows, the CoE can expand to match demand.

3.3 Start Small and Scale Strategically

Ambitious enterprise-wide low-code rollouts often struggle under their own complexity. Starting with manageable pilot projects builds organizational confidence, proves platform value, and identifies challenges before they affect mission-critical systems.

Ideal pilot projects solve real business problems, have committed stakeholders, and complete within weeks rather than months. A department struggling with manual data collection might pilot a PowerApps data entry form that replaces spreadsheet-based processes. Success with this limited scope demonstrates value while teaching teams about platform capabilities and organizational change requirements.

Nsure.com, a mid-sized insurtech firm, faced challenges with manual data validation and quote generation from over 50 insurance carriers, handling more than 100,000 monthly customer interactions. They implemented Power Platform solutions combining PowerApps with AI-driven automation for data validation, quote generation, and appointment rescheduling based on emails. Manual processing reduced by over 60%, enabling agents to sell many times more policies, boosting revenue CAGR, cutting operational costs, and improving customer satisfaction.

Strategic scaling involves identifying patterns from successful pilots and replicating them across the organization. If a sales team’s customer tracking app succeeds, similar patterns might address needs in service, support, and account management.

3.4 Invest in Training and Change Management

Technical platforms alone rarely drive transformation. People need skills, confidence, and motivation to adopt new development approaches. Training programs and change management initiatives address these human factors that determine implementation success.

Effective training differentiates audiences and needs. IT staff require deep technical training on platform architecture, integration capabilities, and advanced features. Citizen developers need practical training focused on building simple applications and following governance standards. Business leaders need executive briefings explaining strategic value and organizational implications.

PowerApps training might include hands-on workshops where participants build functional applications addressing their real needs. This practical approach proves capabilities immediately while building confidence. WebCon training often involves process mapping workshops where business teams identify automation opportunities before learning platform functionality.

Change management addresses resistance, unclear expectations, and competing priorities that slow adoption. Communication campaigns explain why organizations are investing in low-code, success stories demonstrate value, and executive sponsorship signals strategic importance.

4. Selecting a Low-Code Platform That Supports These Principles

Platform selection significantly impacts how well organizations can apply low-code development principles. Different platforms emphasize different capabilities, making alignment between organizational needs and platform strengths essential for success.

Visual development environments should feel intuitive and match how teams naturally think about applications. Platforms requiring extensive training before basic productivity suggest poor alignment with visual-first principles. Evaluating platforms includes hands-on testing where actual intended users build sample applications, revealing usability issues documentation might not capture.

Integration capabilities determine whether platforms can connect with existing organizational systems. PowerApps’ extensive connector library makes it particularly strong for organizations using Microsoft ecosystems and common business applications. WebCon’s flexibility with custom integrations and REST APIs suits organizations with unique legacy systems or specialized software requirements.

Component reusability through libraries and templates should feel natural rather than forced. Platforms demonstrating extensive template marketplaces and active user communities provide head starts on development. Organizations can leverage others’ solutions rather than building everything from scratch.

Scalability and performance capabilities matter even for initial small projects. Platforms should handle growth gracefully without requiring application rewrites as usage expands. Understanding platform limitations helps organizations avoid selecting tools that work for pilots but fail at enterprise scale.

Security and compliance features must meet industry requirements. Organizations in healthcare, finance, or government sectors need platforms with relevant certifications and built-in compliance capabilities. PowerApps and WebCon both maintain enterprise-grade security certifications, but organizations should verify specific compliance needs match platform capabilities.

Vendor stability and support quality influence long-term success. Platforms backed by major technology companies like Microsoft typically receive ongoing investment and maintain compatibility with evolving technology ecosystems.

Cost structures including licensing models, user-based pricing, and infrastructure costs affect total ownership expenses. Understanding how costs scale with organizational adoption prevents budget surprises. Some platforms price by user, others by application or transaction volume. The right model depends on expected usage patterns and organizational size.

5. Common Pitfalls That Violate Low-Code Principles

Organizations frequently stumble over predictable challenges that undermine low-code initiatives. Recognizing these pitfalls helps teams avoid mistakes that waste resources and erode confidence in low-code approaches.

5.1 Insufficient Planning and Requirements Gathering

Lack of thorough planning and inadequate requirements definition significantly contribute to low-code project failure. Without clear understanding of project goals, scope, and specific functionalities, development efforts become misdirected, resulting in products that don’t meet business needs. Organizations might rush into development, leveraging low-code’s speed capabilities, but skip critical planning that ensures applications solve actual problems.

5.2 Governance Failures Creating Application Sprawl

Insufficient governance tops the list of common failures. Organizations embracing citizen development without appropriate oversight create application sprawl, security vulnerabilities, and unsustainable complexity. Applications proliferate without documentation, ownership, or maintenance plans. When the citizen developer who built an app leaves the company, no one understands how to maintain it. Proper governance frameworks prevent these issues by establishing clear standards before problems emerge.

5.3 Integration Challenges with Legacy Systems

Difficulties seamlessly integrating low-code applications with existing legacy IT infrastructure represent a critical failure point. Many organizations rely on complex ecosystems of older systems, databases, and applications. Inability to connect new low-code solutions effectively leads to data silos, broken business processes, and project failure. Lack of adequate integration support from vendors can further exacerbate these challenges. Integration-first design prevents these issues by considering connectivity requirements from initial planning stages.

5.4 Underestimating Performance and Scalability Requirements

Failing to adequately consider long-term performance and scalability needs is a critical pitfall. While low-code platforms facilitate rapid initial development, they may not be inherently suitable for applications expected to experience significant growth in user base, data volume, or transaction processing. Attempts to use low-code platforms for highly complex, transaction-centric applications requiring advanced features like failover and mass batch processing have sometimes fallen short.

5.5 Security and Compliance Lapses

Neglecting security and compliance considerations can result in data breaches, unauthorized access, and legal repercussions. The misconception that low-code applications are inherently secure can lead to complacency and failure to implement robust security measures. Security vulnerabilities arise partly because low-code environments often cater to non-technical users, creating risk that security aspects may be overlooked during development. Citizen developers might build applications exposing sensitive data without appropriate access controls. Building security into development processes through default settings, automated policy enforcement, and mandatory security reviews prevents these risks.

5.6 Inadequate Training Investment

Inadequate training leaves teams unable to use platforms effectively. Organizations might license PowerApps across hundreds of users but provide no training, expecting people to learn independently. This approach wastes licensing costs and capabilities. Investment in comprehensive training programs pays returns through higher adoption rates and better quality applications.

5.7 Lack of Executive Sponsorship

Lack of executive sponsorship dooms initiatives regardless of technical merit. Low-code transformation affects organizational culture, processes, and power structures. Without visible executive support, initiatives face resistance, competing priorities, and inadequate resources. Securing and maintaining executive championship proves as important as technical implementation quality.

6. The Evolution of Low-Code Principles

Low-code development continues evolving as technology advances and organizational experience deepens. Gartner forecasts that by 2026, 70-75% of all new enterprise applications will be built using low-code or no-code platforms, signaling massive adoption growth.

AI integration will advance from augmented development to autonomous development capabilities. Current AI assists developers with suggestions and code generation. Future AI might handle entire application development workflows from natural language descriptions, with AI generating appropriate applications for human review and refinement.

Cross-platform development will become more seamless as low-code platforms mature. Applications might target web, mobile, desktop, and conversational interfaces from single development efforts. This capability will reduce the specialized knowledge required for different platforms while ensuring consistent user experiences across channels.

Integration capabilities will expand beyond connecting existing systems to orchestrating complex workflows across organizational boundaries. Low-code platforms might become primary integration layers that coordinate data and processes across dozens of systems, replacing traditional middleware approaches with more flexible, business-user-friendly alternatives.

Industry-specific solutions and templates will proliferate as platforms mature and user communities grow. Rather than starting from blank canvases, organizations will access pre-built solutions addressing common industry workflows and processes. Healthcare, manufacturing, financial services, and other sectors will develop specialized template libraries that dramatically accelerate implementation.

Organizations investing in low-code development today position themselves for this evolution. Core principles around visual development, reusability, rapid iteration, and governance will remain relevant even as specific capabilities advance. TTMS helps clients build low-code practices that succeed today while remaining flexible enough to incorporate future innovations.

The shift toward low-code represents more than adopting new tools. It reflects fundamental changes in how organizations approach technology development, who participates in creating solutions, and how quickly they respond to changing needs. Embracing these principles positions organizations for sustained competitive advantage as digital transformation continues accelerating across industries.

Understanding and applying principles of low code enables organizations to harness platform capabilities effectively while avoiding common pitfalls that undermine initiatives. Success requires balancing empowerment with governance, speed with quality, and innovation with stability. Organizations mastering this balance gain agility advantages that compound over time as they build libraries of reusable components, develop citizen developer capabilities, and establish sustainable development practices.

TTMS brings deep expertise in implementing low-code solutions that align with these principles, helping organizations navigate platform selection, establish governance frameworks, and build sustainable development capabilities. Whether starting initial pilots or scaling existing initiatives, applying fundamental low-code principles determines whether investments deliver lasting value or create technical debt requiring future remediation.

7. Why Organizations Choose TTMS as a Low-Code Partner

Low-code initiatives rarely fail because of the platform itself. Much more often, problems appear later – when early enthusiasm collides with governance gaps, unclear ownership, or applications that grow faster than the organization’s ability to maintain them. This is where experience matters.

TTMS works with low-code not as a shortcut, but as an engineering discipline. The focus is on building solutions that make sense in the long run – solutions that fit existing architectures, respect security and compliance requirements, and can evolve as business needs change. Instead of isolated applications created under time pressure, the goal is a coherent ecosystem that teams can safely expand.

Clients work with TTMS at different stages of maturity. Some are just testing low-code through small pilots, others are scaling it across departments. In both cases, the approach remains the same: clear technical foundations, transparent governance rules, and practical guidance for teams who will maintain and extend solutions after go-live.

As low-code platforms evolve toward deeper AI support and higher levels of automation, long-term decisions matter more than ever. Organizations looking to discuss how low-code and process automation can be implemented responsibly and at scale can start a conversation directly with the TTMS team via the contact form.

How do we keep control if more people outside IT start building applications?

This concern is fully justified. The answer is not restricting access, but designing the right boundaries. Low-code works best when IT defines the environment, data access rules, and deployment paths, while business teams focus on process logic. Control comes from standards and visibility, not from blocking development. Organizations that succeed usually know exactly who owns each application, where data comes from, and how changes reach production.

What is the real risk of technical debt in low-code platforms?

Technical debt in low-code looks different than in traditional development, but it still exists. It often appears as duplicated logic, inconsistent data models, or workflows that no one fully understands anymore. The risk increases when teams move fast without shared patterns. Applying core principles early – reusability, modularity, and model-driven design – keeps this debt visible and manageable instead of letting it grow quietly in the background.

Can low-code coexist with our existing architecture and legacy systems?

In most organizations, it has to. Low-code rarely replaces core systems; it sits around them, connects them, and fills gaps they were never designed to handle. The key decision is whether low-code becomes an isolated layer or an integrated part of the architecture. When integration patterns are defined upfront, low-code can actually reduce pressure on legacy systems instead of adding complexity.

How do we measure whether low-code is delivering real value?

Speed alone is not a sufficient metric. Early wins are important, but decision-makers should also look at maintainability, adoption, and reuse. Are new applications building on existing components? Are business teams actually using what was delivered? Is IT spending less time on small change requests? These signals usually tell more about long-term value than development time comparisons alone.

At what point does low-code require organizational change, not just new tools?

This point comes surprisingly early. As soon as business teams actively participate in building solutions, roles and responsibilities shift. Someone needs to own standards, templates, and training. Someone needs to decide what is “good enough” to go live. Organizations that treat low-code purely as a tool often struggle. Those that treat it as a shared capability tend to see lasting benefits.

When is the right moment to introduce governance in a low-code initiative?

Earlier than most organizations expect. Governance is much easier to establish when there are five applications than when there are fifty. This does not mean heavy processes or bureaucracy from day one. Simple rules around environments, naming conventions, data access, and ownership are often enough at the start. As adoption grows, these rules can evolve. Waiting too long usually leads to clean-up projects that are far more costly than doing things right from the beginning.

Read more