Accounting firms of all sizes – from local practices to global audit networks – face increasing pressure to comply with anti-money laundering (AML) regulations. Regulators in the European Union have expanded and tightened AML requirements through directives like the 5th Anti-Money Laundering Directive (5AMLD) and 6AMLD. These laws classify accountants, auditors, and tax advisors as “obliged entities,” meaning they must implement robust AML procedures or risk hefty fines and reputational damage. In this landscape, larger accounting firms especially grapple with high client volumes and complex operations that make manual compliance approaches impractical. As a result, many firms are turning to automation to meet their AML obligations efficiently and ensure full regulatory compliance.

EU AML Regulations for Accounting Firms

The EU’s anti-money laundering framework – notably the Fourth, Fifth, and Sixth AML Directives (4AMLD, 5AMLD, 6AMLD) – imposes stringent obligations on accounting and professional services firms. 5AMLD (Directive (EU) 2018/843), implemented in 2020, broadened the scope of AML laws to cover a wider range of businesses and emphasized transparency and due diligence. It reinforced requirements for customer due diligence (Know Your Customer checks), beneficial ownership verification, ongoing monitoring of client activity, and prompt suspicious activity reporting. The subsequent 6AMLD, effective 2021, further harmonized the definition of money laundering offenses and extended liability to companies and their management, introducing tougher penalties for compliance failures.

In practice, this regulatory regime requires accounting firms to maintain comprehensive AML programs – regardless of firm size – or face enforcement actions. Even prominent international accounting firms have faced penalties for AML lapses, underscoring that no one is exempt from these rules. To stay compliant, firms must be proactive in implementing the necessary controls and staying up-to-date with evolving regulations (the EU is even moving toward a new AML Regulation and centralized AML Authority in coming years).

Key AML Obligations for Accounting Firms

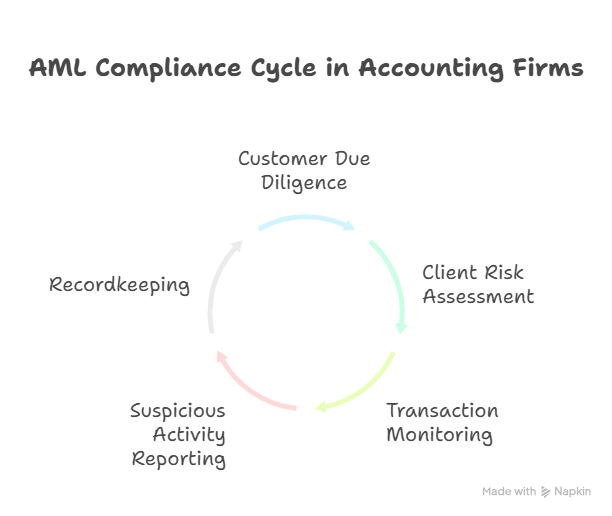

Under EU directives and local laws, accounting practices must fulfill several core AML obligations as part of their day-to-day operations. These include:

- Customer Due Diligence (KYC): Firms must verify each client’s identity and understand who they are doing business with. This involves obtaining and checking official identification documents, identifying ultimate beneficial owners of corporate clients, and screening clients against sanctions lists and politically exposed persons (PEP) databases. Effective KYC procedures ensure the firm “knows its customer” and can assess any potential risk factors at onboarding.

- Client Risk Assessment: Accounting firms are required to adopt a risk-based approach by evaluating each client’s profile for money laundering risk. This means considering factors like the client’s industry, geographic exposure, complexity of ownership structure, and any high-risk indicators (for example, a client from a high-risk jurisdiction or a client who is a PEP). Firms must assign a risk rating (e.g. low, medium, high) to each client and apply enhanced due diligence for higher-risk cases. Regular re-assessment of client risk is also a part of this obligation.

- Transaction Monitoring: Especially in larger firms or those handling client funds, there is an expectation to monitor financial transactions and client account activity for unusual or suspicious patterns. This could include reviewing transactions that are unusually large, irregular transfers that don’t match the client’s profile, or complex payment chains. Ongoing transaction monitoring helps detect potential money laundering schemes in real time and is a crucial defensive mechanism alongside initial due diligence.

- Suspicious Activity Reporting: If an accountant or firm suspects that a client’s transaction or behavior may be linked to criminal activity, they are legally obligated to file a Suspicious Activity Report (SAR) with the country’s financial intelligence unit. This must be done without tipping off the client. Timely reporting of suspicions is critical – it enables authorities to investigate and also shields the firm from liability by demonstrating compliance. Accounting firms need clear internal escalation procedures so that staff promptly flag and report red flags.

- Recordkeeping: AML laws mandate that firms maintain detailed records of all the above due diligence measures and client transactions for a minimum period (typically at least five years after a business relationship ends or a transaction is completed). This includes copies of identification documents, records of risk assessments, transaction logs, and communication related to any findings. Proper recordkeeping ensures that the firm can provide evidence of compliance to regulators and auditors upon request, and it helps in any future investigations.

Common AML Compliance Challenges for Accounting Firms

Implementing these AML procedures is not without challenges. Many accounting offices – even well-resourced ones – struggle with inefficiencies and gaps that can undermine compliance efforts. Some of the most common challenges include:

- Fragmented processes and data silos: Often the information and steps required for AML compliance are spread across multiple systems or departments. For example, client identification documents might be stored in physical files or disparate databases, while transaction records and risk assessments reside elsewhere. This fragmentation makes it difficult to get a comprehensive view of compliance for each client. It also leads to inconsistent practices across an organization, especially in larger firms with many offices. Siloed data and disconnected workflows increase the risk of something falling through the cracks, as there is no single source of truth for a client’s AML status.

- Manual onboarding and verification: Without the right tools, client due diligence at onboarding can be a labor-intensive manual process. Staff may have to collect passports or company documents via email or paper, manually check government registries or sanctions lists, and fill out forms by hand. Manual checks are not only slow – delaying client intake – but also prone to human error. Important steps might be overlooked or documented improperly. Inconsistent manual verification also means the quality of KYC can vary from case to case, which is problematic for compliance. For a large firm onboarding high volumes of clients, a purely manual approach becomes unsustainable.

- Lack of continuous monitoring: Many accounting firms perform due diligence at the start of a client relationship but do not actively monitor the client’s profile or transactions on an ongoing basis. Without continuous monitoring, changes in a client’s risk profile can go unnoticed – for instance, if a client is added to a sanctions list or is involved in suspicious transactions after the initial onboarding, the firm might miss these red flags. Periodic reviews (if done annually or ad hoc) might come too late. This gap leaves firms exposed between formal review points. Regulators expect “ongoing due diligence,” so a lack of real-time monitoring can lead to non-compliance and missed opportunities to report suspicions promptly.

How Automation Ensures AML Compliance in Accounting Firms

AML automation directly addresses the above challenges and helps accounting firms meet regulatory requirements more reliably. By leveraging specialized compliance software and technology platforms, firms can transform their AML procedures in the following ways:

- Integrated and efficient workflows: Automation unifies all AML processes in one system – from client onboarding and ID verification to risk scoring, transaction tracking, and reporting. This integration eliminates fragmented processes. All client data and compliance actions are stored centrally, giving compliance officers a complete overview at a glance. With a single platform managing end-to-end due diligence, there are fewer gaps or overlaps. This not only improves consistency across the firm (every office or team follows the same procedure) but also makes internal and external audits far easier since information is organized and readily accessible.

- Faster, more accurate KYC: Automated solutions streamline the KYC process by digitizing identity verification and document collection. For example, clients can submit identification through secure online portals, and the system can automatically verify IDs and extract information. Automation can also cross-check clients against up-to-date sanctions, PEP, and watchlists within seconds – something that would take a person much longer. By using AI or API integrations to verify beneficial ownership data and retrieve information from company registries, an automated platform drastically reduces the manual workload. The result is quicker onboarding without sacrificing thoroughness. Plus, automated checks are applied uniformly to every client, reducing the risk of human oversight or bias.

- Continuous monitoring and real-time alerts: One of the greatest advantages of AML automation is the ability to continuously monitor clients and transactions. Software can run in the background to track client transactions for anomalies and regularly rescreen clients against sanctions/PEP databases. If a client’s risk profile changes – say, their name appears in negative news or a sanctions list update – the system can immediately alert compliance staff. Likewise, unusual transaction patterns (e.g. sudden large transfers or multiple cash deposits that deviate from a client’s usual activity) can be flagged automatically. This always-on vigilance is practically impossible to achieve with manual processes. Continuous monitoring ensures that suspicious activities are caught and addressed in a timely manner, keeping the firm aligned with the “ongoing due diligence” expectations of regulators.

- Reduced error and improved consistency: By automating repetitive compliance tasks, accounting firms minimize the chance of human error – such as missed screenings or improper document filing. The software can enforce mandatory fields and checklists (e.g. requiring a risk assessment to be completed before an account is fully opened), ensuring nothing is skipped. Every client goes through the same standardized workflow. This consistency not only aids compliance but also makes training staff easier since the process is clearly defined in the system. When regulators examine the firm’s AML program, they are more likely to see a uniform, well-documented approach that meets the required standards.

- Streamlined reporting and recordkeeping: Automation helps generate the reports and audit trails needed for regulatory compliance. When a suspicious transaction is flagged, many AML platforms can assist in compiling the necessary details for a Suspicious Activity Report, even pre-filling certain information, which saves time in critical moments. All AML actions – from who verified a passport to when a risk score was updated – are logged by the system. This creates a clear audit trail. In terms of recordkeeping, an electronic system securely stores KYC documents, risk assessment forms, and transaction records, automatically timestamped and indexed. Retrieving records for a regulatory inspection or an internal review becomes quick and foolproof. Because the records are digital and backed up, firms are better protected against data loss (contrast this with chasing down papers in filing cabinets). Overall, automated recordkeeping ensures the firm can readily demonstrate compliance and meet the five-year (or longer) retention requirements without worrying about missing files.

Embracing AML Automation for Compliance

For accounting firms – particularly larger ones handling thousands of clients and complex engagements – adopting an AML automation solution is rapidly becoming essential. Automation not only resolves the operational pain points of compliance but also provides confidence that the firm is meeting the letter and spirit of the law. With regulators continuously raising the compliance bar, an investment in the right technology is an investment in the firm’s future stability.

By implementing a modern AML software platform, firms can ensure that all required checks (from KYC to transaction surveillance) are performed consistently and efficiently. Compliance officers can then focus on analyzing truly suspicious cases rather than chasing paperwork. Moreover, automated systems are frequently updated to reflect the latest regulatory changes – meaning the firm’s procedures stay in alignment with new rules (such as updates in EU directives or sanction regimes) with minimal manual rework. In short, automation allows accounting practices to scale up their AML defenses in a cost-effective way, turning a compliance burden into a managed business process.

AMLTrack – Intelligent AML Compliance for Accounting Firms

AMLTrack is an AI-powered compliance platform designed to meet the specific needs of accounting firms, auditors, and tax advisors. It automates every stage of the AML process – from digital client onboarding and beneficial ownership verification to continuous monitoring and suspicious activity reporting. Integrated with EU and international sanctions lists, PEP databases, and company registries, AMLTrack ensures that client checks are completed within seconds and applied consistently across the firm. Real-time monitoring flags unusual transactions or changes in a client’s risk profile, while built-in risk scoring models standardize how risk is assessed across offices and teams. The system also creates a complete, audit-ready record of all AML actions, making it easy to demonstrate compliance to regulators or internal auditors. Scalable and cloud-ready, AMLTrack supports both small practices and global networks, helping firms reduce compliance costs, eliminate manual inefficiencies, and focus their expertise on truly high-risk cases.

Do small accounting firms need AML compliance procedures?

Yes. Under EU regulations such as the 5th Anti-Money Laundering Directive (5AMLD), all accounting firms—regardless of size—are classified as “obliged entities” and must implement AML procedures. While larger firms typically face greater scrutiny due to higher volumes of clients and transactions, even small practices must conduct proper client identification, perform risk assessments, and report suspicious activities.

What is the biggest AML compliance challenge for accounting offices?

One of the biggest challenges is managing fragmented and manual compliance processes. Many firms still rely on spreadsheets, paper files, and manual checks, resulting in inconsistent client vetting and increased risk of errors or missed red flags. Without centralized systems, firms often struggle to meet regulatory expectations effectively and efficiently.

How often should accounting firms review their clients’ AML risk profiles?

EU AML regulations require ongoing monitoring of clients, not just one-time checks at onboarding. Best practice is to reassess client risks regularly—typically at least annually or whenever there’s a significant change in client activity or external risk factors (such as new sanctions lists or negative news). Automation significantly simplifies continuous monitoring and reduces the manual workload associated with these periodic reviews.

Can automation really reduce AML compliance costs for accounting firms?

Yes, automation substantially lowers compliance costs by streamlining client due diligence, identity verification, and transaction monitoring. It reduces the amount of manual labor required, accelerates onboarding, and ensures regulatory requirements are consistently met without hiring additional compliance staff. In the long run, automation saves firms money by preventing regulatory fines and enhancing operational efficiency.

Are accounting firms responsible for their clients’ suspicious transactions?

Accounting firms are required by law to report any suspicious activity identified during the course of their professional duties. Firms are not responsible for the client’s actions, but they must implement procedures to detect, evaluate, and report suspicious transactions promptly. Failing to report or adequately assess these risks can lead to significant regulatory fines and reputational damage.