Top 10 IT Companies in Poland Serving the Pharmaceutical Industry (2026 Ranking)

The pharmaceutical industry relies on advanced IT solutions – from clinical data management and AI-driven drug discovery to secure patient portals and regulatory compliance systems. Poland’s tech sector hosts a range of providers experienced in delivering these solutions for pharma companies. Below is a ranking of the Top 10 Polish IT service providers for the pharma sector in 2026. These companies combine technical excellence with domain knowledge in life sciences, helping pharma organizations innovate while meeting strict regulations. Each entry includes key facts like 2024 revenue and workforce size, as well as main service areas.

1. Transition Technologies MS (TTMS)

TTMS leads the pack as a Poland-headquartered IT partner with deep expertise in pharmaceutical projects. Operating since 2015, TTMS has grown rapidly by delivering scalable, high-quality software and managed IT services for regulated industries. The company’s 800+ specialists support global pharma clients in areas ranging from clinical trial management systems to validated cloud platforms. TTMS stands out for its AI-driven solutions – for example, implementing artificial intelligence to automate tender analysis and improve drug development pipelines. As a certified partner of Microsoft, Adobe, Salesforce, and more, TTMS offers end-to-end support, from quality management and computer system validation to custom application development. Its strong pharma portfolio (including case studies in AI for R&D and digital engagement) underscores TTMS’s ability to combine innovation with compliance.

| TTMS: company snapshot | |

|---|---|

| Revenues in 2024: | PLN 233.7 million |

| Number of employees: | 800+ |

| Website: | https://ttms.com/pharma-software-development-services/ |

| Headquarters: | Warsaw, Poland |

| Main services / focus: | AEM, Azure, Power Apps, Salesforce, BI, AI, Webcon, e-learning, Quality Management |

2. Sii Poland

Sii Poland is the country’s largest IT outsourcing and engineering company, with a substantial track record in the pharma domain. Founded in 2006, Sii has over 7,700 professionals and offers broad expertise – from software development and testing to infrastructure management and business process outsourcing. Its teams have supported pharmaceutical clients by developing laboratory information systems, validating applications for FDA compliance, and providing IT specialists (e.g. data analysts, QA engineers) under flexible outsourcing models. With 16 offices across Poland and a reputation for quality delivery, Sii can execute large-scale pharma IT projects while ensuring GxP standards and data security are met.

| Sii Poland: company snapshot | |

|---|---|

| Revenues in 2024: | PLN 2.13 billion |

| Number of employees: | 7700+ |

| Website: | www.sii.pl |

| Headquarters: | Warsaw, Poland |

| Main services / focus: | IT outsourcing, engineering, software development, BPO, testing, infrastructure services |

3. Asseco Poland

Asseco Poland is the largest Polish-owned IT group and a powerhouse in delivering technology to regulated sectors. With origins dating back to 1991, Asseco today operates in over 60 countries (33,000+ staff globally) and reported PLN 17.1 billion in 2024 revenue (group level). In the pharmaceutical field, Asseco leverages its experience in enterprise software to offer validated IT systems, data integration, and software outsourcing services. The company’s portfolio includes healthcare and life-sciences solutions – from hospital and laboratory systems to drug distribution platforms – ensuring interoperability and compliance with EU and FDA regulations. Asseco’s deep R&D capabilities and local presence (headquartered in Rzeszów with major offices across Poland) make it a trusted partner for pharma companies seeking long-term, reliable IT development and support.

| Asseco Poland: company snapshot | |

|---|---|

| Revenues in 2024: | PLN 17.1 billion (group) |

| Number of employees: | 33,000+ (global) |

| Website: | pl.asseco.com |

| Headquarters: | Rzeszów, Poland |

| Main services / focus: | Proprietary software products, custom system development, IT outsourcing, digital government solutions, life sciences IT |

4. Comarch

Comarch, founded in 1993, is a leading Polish IT provider with a strong footprint in healthcare and industry. With 6,500+ employees and 20+ offices in Poland, Comarch blends product development with IT services. In the pharma and medtech sector, Comarch’s Healthcare division offers solutions like electronic health record platforms, remote patient monitoring, and telemedicine systems – all crucial for pharma companies engaged in clinical research or patient support programs. Comarch also provides custom software development, integration, and IT outsourcing services, tailoring its broad portfolio (ERP, CRM, business intelligence, IoT) to the needs of pharmaceutical clients. Known for robust R&D and secure infrastructure (including its own data centers), Comarch helps pharma firms improve operational efficiency and data-driven decision making.

| Comarch: company snapshot | |

|---|---|

| Revenues in 2024: | PLN 1.916 billion |

| Number of employees: | 6500+ |

| Website: | www.comarch.com |

| Headquarters: | Kraków, Poland |

| Main services / focus: | Healthcare IT (EHR, telemedicine), ERP & CRM systems, custom software development, cloud services, IoT solutions |

5. Euvic

Euvic is a fast-growing Polish IT group that has become a major player through the federation of dozens of tech companies. With around 5,000 IT specialists and an estimated PLN 2 billion in annual revenue, Euvic delivers a wide spectrum of IT services. For pharmaceutical clients, Euvic’s team offers everything from custom application development and integration (e.g. R&D data platforms, CRM for pharma sales) to analytics and cloud infrastructure management. The group’s decentralized structure allows it to tap specialized skills (AI, data science, mobile, etc.) across its subsidiaries. This means a pharma company can find in Euvic a one-stop partner for digital transformation – whether implementing a secure patient mobile app, automating supply chain processes, or migrating legacy systems to the cloud. Euvic’s scale and flexible engagement models have made it a preferred IT vendor for several life sciences enterprises in Central Europe.

| Euvic: company snapshot | |

|---|---|

| Revenues in 2024: | ~PLN 2 billion (est.) |

| Number of employees: | 5000+ |

| Website: | www.euvic.com |

| Headquarters: | Gliwice, Poland |

| Main services / focus: | Custom software & integration, cloud services, AI & data analytics, IT outsourcing, consulting |

6. Billennium

Billennium is a Poland-based IT services company known for its strong partnerships with global pharma and biotech clients. Established in 2003, Billennium has expanded worldwide (nearly 1,800 employees across Europe, Asia, and North America) and achieved record revenues of PLN 351 million in 2022 (with continued growth through 2024). In the pharmaceutical arena, Billennium provides teams and solutions for enterprise application development, cloud transformation, and AI implementations. The company has helped pharma organizations modernize core systems (for example, deploying Salesforce-based platforms for customer management), and it offers validated software development aligned with GMP/GAMP5 quality standards. With expertise in cloud (Microsoft Azure, AWS) and data analytics, Billennium ensures pharma clients can leverage emerging technologies while maintaining compliance. Its mix of expert IT staffing and managed services makes Billennium a flexible partner for both short-term projects and long-term digital initiatives in life sciences.

| Billennium: company snapshot | |

|---|---|

| Revenues in 2024: | ~PLN 400 million (est.) |

| Number of employees: | 1800+ |

| Website: | www.billennium.com |

| Headquarters: | Warsaw, Poland |

| Main services / focus: | IT outsourcing & team leasing, cloud solutions (Microsoft, AWS), custom software development, AI & data, Salesforce solutions |

7. Netguru

Netguru is a prominent Polish software development and consultancy company, acclaimed for building cutting-edge digital products. Headquartered in Poznań and operating globally, Netguru has around 600+ experts in web and mobile development, UX/UI design, and strategy. While Netguru’s portfolio spans many industries, it has delivered innovative solutions in healthcare and pharma as well – such as patient-facing mobile apps, telehealth platforms, and internal tools for pharma sales teams. Netguru’s agile approach and focus on user-centric design help pharma clients create engaging applications (for patients, doctors, or field reps) that are also secure and compliant. With ~PLN 300 million in annual revenue (2022) and recognition as one of Europe’s fastest-growing companies, Netguru combines startup-like innovation with enterprise-level reliability. Pharma companies turn to Netguru to accelerate their digital transformation initiatives – whether it’s prototyping an AI-powered health app or scaling up an existing platform to global markets.

| Netguru: company snapshot | |

|---|---|

| Revenues in 2024: | ~PLN 300 million (est.) |

| Number of employees: | 600+ |

| Website: | www.netguru.com |

| Headquarters: | Poznań, Poland |

| Main services / focus: | Custom software & app development, UX/UI design, digital product strategy, mobile and web solutions, innovation consulting |

8. Lingaro

Lingaro is a Polish-born data analytics powerhouse that has made its mark delivering business intelligence and data engineering solutions. Founded in Warsaw, Lingaro grew to over 1,300 employees and an estimated PLN 500 million in 2024 revenue by serving Fortune 500 clients. In pharma, where data-driven decisions are critical (from R&D analytics to supply chain optimization), Lingaro provides end-to-end services: data warehouse development, big data platform integration, advanced analytics, and AI/ML solutions. They have built analytics dashboards for pharmaceutical sales and marketing, implemented data lakes to consolidate research data, and ensured compliance with GDPR and HIPAA in data handling. Lingaro’s strength lies in merging technical prowess (across Azure, AWS, and Google Cloud) with a deep understanding of data governance. For pharma companies aiming to become more data-driven and insight-rich, Lingaro offers a proven track record in transforming raw data into actionable intelligence.

| Lingaro: company snapshot | |

|---|---|

| Revenues in 2024: | ~PLN 500 million (est.) |

| Number of employees: | 1300+ |

| Website: | www.lingarogroup.com |

| Headquarters: | Warsaw, Poland |

| Main services / focus: | Data analytics & visualization, data engineering & warehousing, AI/ML solutions, cloud data platforms, analytics consulting |

9. ITMAGINATION

ITMAGINATION is a Warsaw-based IT consulting and software development firm known for accelerating innovation in enterprises. With around 400+ professionals, ITMAGINATION has served clients in banking, telecom, and also collaborated with pharmaceutical corporations on digital initiatives. The company offers custom development, data analytics, and cloud services – for example, building data platforms that unify clinical and operational data, or developing custom software to automate specific pharma workflows. ITMAGINATION’s expertise in Microsoft technologies (Azure cloud, Power BI, .NET) and agile delivery make it well-suited for pharma projects that require quick turnaround and strict quality control. In recent years, ITMAGINATION has also focused on AI solutions and machine learning, which can be applied to pharma use cases like predictive analytics for patient adherence or drug supply optimization. Now part of a larger global group (via acquisition by Virtusa in 2023), ITMAGINATION combines Polish tech talent with international reach, benefitting pharma clients with scalable delivery and domain know-how.

| ITMAGINATION: company snapshot | |

|---|---|

| Revenues in 2024: | ~PLN 150 million (est.) |

| Number of employees: | 400+ |

| Website: | www.itmagination.com |

| Headquarters: | Warsaw, Poland |

| Main services / focus: | Custom software development, data & BI solutions, Azure cloud services, IT consulting, staff augmentation |

10. Ardigen

Ardigen is a specialist IT company at the intersection of biotechnology and software, making it a unique player in this list. Based in Kraków, Poland, Ardigen focuses on AI-driven drug discovery and bioinformatics solutions for pharma and biotech clients worldwide. Its team of around 150 bioinformatics engineers, data scientists, and software developers builds platforms that accelerate R&D – such as AI models for identifying drug candidates, machine learning tools for personalized medicine, and advanced software for analyzing genomic data. Ardigen’s deep domain expertise in areas like immunology and molecular biology sets it apart: it understands the science behind pharma, not just the code. For pharmaceutical companies looking to leverage artificial intelligence in research or to implement complex algorithms (while navigating compliance with new EU AI regulations and GMP standards), Ardigen is a go-to partner. The company’s rapid growth and cutting-edge projects (often in collaboration with top global pharma firms) highlight Poland’s contribution to innovation in life sciences IT.

| Ardigen: company snapshot | |

|---|---|

| Revenues in 2024: | ~PLN 50 million (est.) |

| Number of employees: | 150+ |

| Website: | www.ardigen.com |

| Headquarters: | Kraków, Poland |

| Main services / focus: | AI/ML in drug discovery, bioinformatics, data science, precision medicine software, digital biotech solutions |

Why Choose Polish IT Companies for Pharma

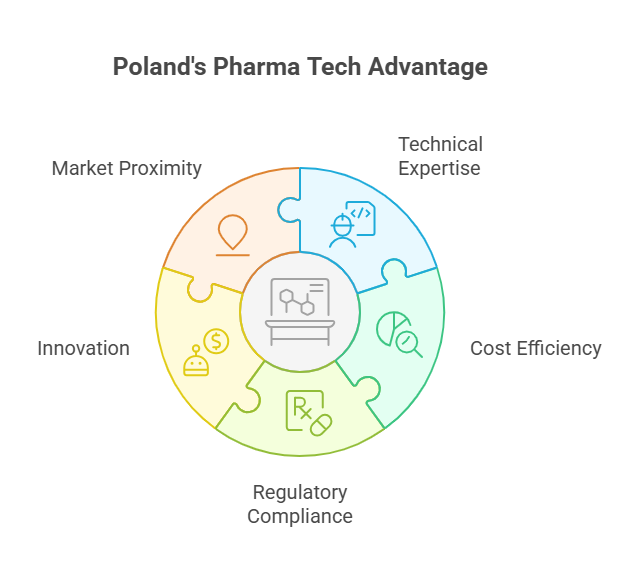

Polish IT companies have built a strong reputation for combining technical expertise with cost efficiency, making them attractive partners for global pharma organizations. The country offers a large pool of highly educated specialists who are experienced in working under strict EU and FDA regulations. Many Polish providers also invest heavily in R&D and AI, ensuring access to the latest innovations in data analytics, clinical platforms, and digital health. Their proximity to major European markets guarantees smooth communication and alignment with regulatory frameworks. This unique mix of skills, compliance, and innovation positions Poland as a reliable hub for pharma technology services.

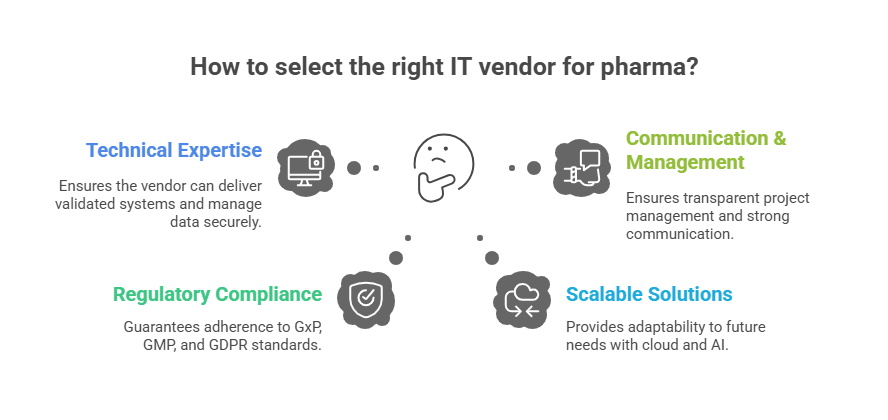

Key Factors When Selecting a Pharma IT Partner

Selecting the right IT vendor for pharma requires careful consideration of both technical and regulatory capabilities. Beyond standard expertise in software development, providers must demonstrate experience with GxP, GMP, and GDPR compliance. It is also critical to assess their track record in delivering validated systems and managing sensitive patient or clinical data securely. Decision-makers should evaluate whether the partner offers scalable solutions, such as cloud and AI, that can adapt to future needs. Finally, strong communication, transparent project management, and industry references are essential to ensuring long-term success in pharma IT projects.

Leverage TTMS for Pharma IT Success – Our Experience in Action

Choosing the right technology partner is crucial for pharmaceutical companies to innovate safely and efficiently. Transition Technologies MS (TTMS) offers the full spectrum of IT services tailored to the pharma sector, backed by a rich portfolio of successful projects. We invite you to explore some of our impactful case studies – each demonstrating TTMS’s ability to solve complex pharma challenges with technology. Below are our latest case studies showing how we support global clients in transforming their business:

- Chronic Disease Management System – A digital therapeutics solution for diabetes care, integrating insulin pumps and glucose sensors to improve adherence.

- Business Analytics and Optimization – Data-driven insights enabling pharmaceutical organizations to optimize performance and enhance decision-making.

- Vendor Management System for Healthcare – Streamlining contractor and vendor processes in pharma to ensure compliance and efficiency.

- Patient Portal (PingOne + Adobe AEM) – A secure and high-performance patient platform with integrated single sign-on for safe access.

- Automated Workforce Management – Replacing spreadsheets with an integrated system to improve planning and save costs.

- Supply Chain Cost Management – Enhancing transparency and control over supply chain costs in the pharma industry.

- Customized Finance Management System – Building a tailor-made finance platform to meet the specific needs of a global enterprise.

- Reporting and Data Analysis Efficiency – Improving reporting speed and quality with advanced analytics tools.

- SAP CIAM Implementation for Healthcare – Delivering secure identity and access management for a healthcare provider.

Each of these examples showcases TTMS’s commitment to quality, innovation, and understanding of pharma regulations. Whether you need to modernize legacy systems, harness AI for research, or ensure compliance across your IT landscape – our team is ready to help your pharmaceutical business thrive in the digital age. Contact us to discuss how we can support your goals with proven expertise and tailor-made solutions.

How do IT vendors support regulatory inspections in the pharma sector?

IT vendors experienced in pharma often build solutions with audit trails, automated reporting, and strict access control that make regulatory inspections smoother. They also provide documentation aligned with GMP and GAMP5 standards, which inspectors typically require. Some vendors offer validation packages that demonstrate compliance from day one. This not only reduces inspection risks but also saves valuable time during audits. Ultimately, an IT partner becomes part of the compliance ecosystem rather than just a technology supplier.

Can Polish IT providers help reduce the time-to-market for new drugs?

Yes, Polish IT providers frequently implement AI and automation to speed up processes like clinical trial management, data analysis, and patient recruitment. Faster and more reliable data handling allows pharma companies to make informed decisions more quickly. These efficiencies shorten the development timeline and can lead to earlier regulatory submissions. In some cases, innovative platforms built in Poland have cut months from the R&D cycle. This ability to accelerate time-to-market is one of the biggest advantages of working with a tech-savvy partner.

What role does data security play in choosing a pharma IT partner?

Data security is paramount in pharma because of the sensitivity of patient information and clinical data. A reliable vendor must follow strict cybersecurity protocols, encryption standards, and comply with GDPR and HIPAA. Many Polish providers invest in secure data centers and cloud platforms certified by global standards. They also implement monitoring and anomaly detection systems to prevent breaches. Companies that prioritize data security not only protect patient trust but also safeguard the company’s reputation.

How do cultural and geographic factors influence collaboration with Polish IT firms?

Poland’s central location in Europe ensures overlapping working hours with both Western Europe and North America, which improves communication. Cultural proximity and strong English proficiency make collaboration smoother than with many offshore destinations. Additionally, Polish teams often adopt agile methodologies that encourage transparency and regular feedback. This makes cooperation with global pharma firms efficient and predictable. Such cultural and geographic alignment is a hidden but powerful advantage when selecting a vendor.

Are Polish IT providers active in emerging areas like digital therapeutics and AI in drug discovery?

Absolutely, many Polish IT companies are pioneers in digital therapeutics, mobile health apps, and AI solutions tailored for drug discovery. They collaborate closely with research organizations and biotech startups, bringing innovation directly into pharma pipelines. For example, AI algorithms can help identify promising compounds or predict patient responses. Digital therapeutics developed by Polish teams support patient engagement and improve adherence to treatment. This forward-looking expertise ensures pharma companies are prepared for the future of medicine.