AML in the Art Market: Automation for Safe and Transparent Transactions

Did you know that criminals launder an estimated $3 billion through art each year? The global art market – worth over $65 billion annually – has long been a target for illicit finance. Fraudsters and kleptocrats have taken advantage of the art world’s secrecy and soaring prices to turn “dirty” money into legitimate assets. This article explores why art is so attractive for money laundering and how European anti-money laundering (AML) laws – particularly the 5th AML Directive – impose new duties on art galleries and auction houses. We’ll also discuss the serious risks of non-compliance and how automation can help art businesses meet their AML obligations, ensuring safer, more transparent transactions.

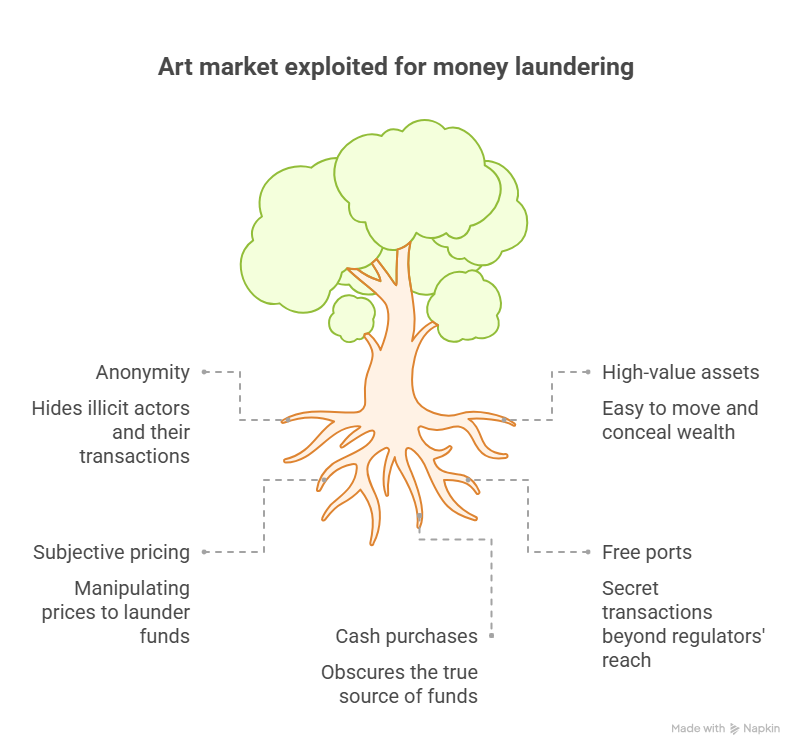

Why the Art Market Attracts Money Launderers

The art market’s allure for money launderers comes down to its unique combination of high value and opacity. A painting or sculpture can be worth millions yet is easily portable and concealable. In fact, art is often described as an “ideal playground for money laundering”. Here are some key reasons why criminals turn to art:

- Anonymity and secrecy: Art sales have traditionally been private, with buyers and sellers able to remain anonymous through shell companies or agents. Until recently, dealers and auction houses had no legal obligation to identify clients or report suspicious activities, allowing illicit actors to operate in the shadows.

- High-value, portable assets: Artworks pack immense value into a small package – a single painting can be worth tens of millions. These assets can be moved across borders or kept in offshore storage with little detection. For example, small collectibles like rare coins or antiquities can be smuggled easily, making art a convenient vehicle to transfer wealth secretly.

- Subjective pricing: There’s no fixed “market price” for a masterpiece – value is in the eye of the beholder. This subjectivity lets criminals manipulate prices to launder funds. They might overpay for a piece using dirty money and later sell it for a “clean” profit, or trade art at an inflated or deflated price between colluding parties to obscure the money trail.

- Free ports and storage: Valuable art is often stored in tax-free port warehouses (in jurisdictions like Geneva or Monaco) that offer high security and anonymity. Art can sit in a free port for years “in transit,” changing ownership on paper without ever leaving the warehouse. This makes it easy to conduct secret transactions beyond the reach of most regulators.

- Cash purchases and intermediaries: Traditionally, art deals could be done in cash, and auction houses often dealt with intermediaries rather than the ultimate buyer. This meant the true source of funds could be obscured. Many major auction houses historically did not ask for the identity of the actual client or ultimate beneficial owner (UBO) behind a purchase. Such gaps have been exploited by money launderers to inject illicit cash into the art trade without scrutiny.

These factors have led to notorious cases where art was used to launder money. In one U.S. case, drug traffickers accepted 33 paintings as payment for narcotics and planned to resell them to “clean” the money, a scheme that landed the perpetrators in prison. As law enforcement notes, the volume of questionable transactions in the art market is noticeably higher than in other sectors. Recognizing this vulnerability, authorities worldwide have begun closing the loopholes that made art a safe haven for illicit funds.

EU AML Legislation: 5AMLD and the Art Sector

In the European Union, regulators responded to the art market’s money-laundering risks by extending AML laws to art businesses. The Fifth Anti-Money Laundering Directive (5AMLD), which took effect January 2020, explicitly brought art dealers, galleries, and auction houses into the scope of AML regulation. Under 5AMLD’s definition, any “persons trading or acting as intermediaries in the trade of works of art, including when carried out by art galleries and auction houses,” as well as those storing or trading art in free ports, are considered “obliged entities” when transactions exceed €10,000. In practice, this means if you operate in the EU art market and engage in high-value sales (even as a series of linked transactions), you must follow the same AML requirements as banks and other financial institutions.

Crucially, EU legislation requires a risk-based approach to AML in the art sector. Galleries and auction houses must assess the risk of money laundering in each transaction and client relationship, focusing more effort on higher-risk cases (such as unusual payments or politically exposed buyers). The 4th AML Directive had already covered businesses receiving large cash payments (≥ €10,000), but 5AMLD went further by targeting the art trade’s particular vulnerabilities. In short, anonymity is no longer an acceptable norm – European law now requires art market participants to disclose buyer and seller identities and scrutinize the source of funds.

It’s also worth noting the Sixth Anti-Money Laundering Directive (6AMLD), which EU member states implemented starting 2021, strengthens penalties and enforcement. 6AMLD harmonizes the definition of money laundering across the EU and imposes tougher punishments on individuals and companies involved. For example, it sets a minimum prison term (often around four years) for serious money laundering offenses and can hold companies liable for facilitating money laundering. Together, 5AMLD and 6AMLD send a clear signal: art businesses in Europe must take AML compliance seriously, or face severe consequences.

Key AML Obligations for Galleries and Auction Houses

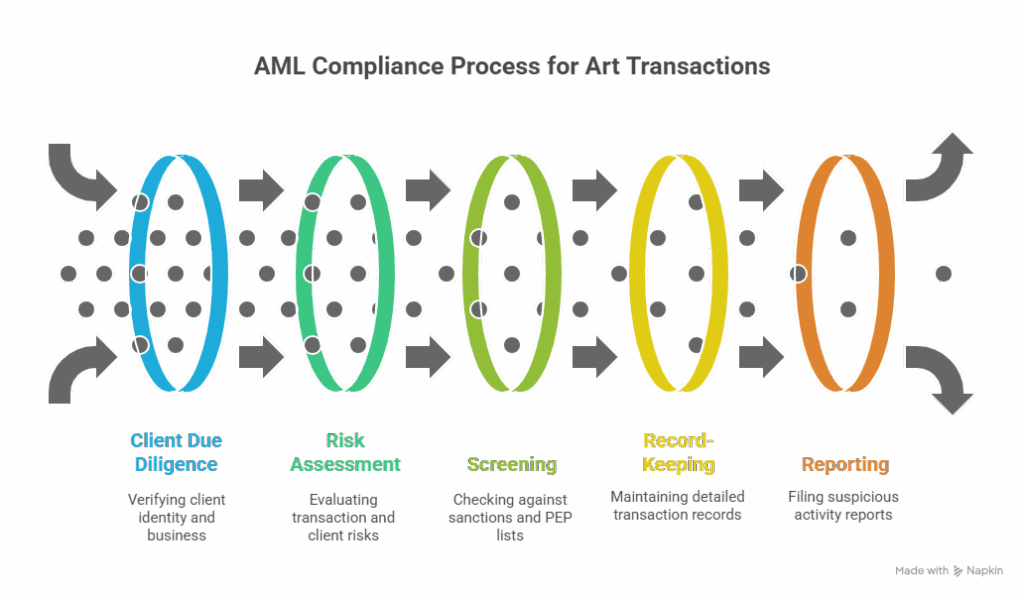

Under these EU directives (and equivalent UK regulations for British art market participants), galleries and auction houses now have concrete AML duties. In practice, art businesses must establish internal compliance programs similar to those in finance. The key obligations include:

- Client due diligence (CDD): Verify the identity of clients and collect relevant information before completing a sale. This “Know Your Customer” process means obtaining official ID documents, proof of address, and understanding the nature of the client’s business and funds. If the client is a company or buying through an agent, the gallery must identify the ultimate beneficial owner (UBO) – the real person behind the transaction – and verify their identity.

- Risk assessment and ongoing monitoring: Evaluate each client and transaction for risk factors (e.g. unusually high-value purchases, payments from high-risk countries, politically exposed persons) and apply proportional scrutiny. After onboarding, continue to monitor transactions for any red flags. Large or complex transactions that lack obvious economic rationale should prompt further inquiry into the source of funds. Galleries should also pay attention to any changes in a client’s profile or behavior over time.

- Screening against sanctions and PEP lists: Check clients’ names against international sanctions lists and databases of politically exposed persons (PEPs) as part of due diligence. If a collector is a sanctioned individual or a high-profile political figure, enhanced due diligence and potentially rejecting the transaction may be required. Similarly, scanning for adverse media (negative news) about clients can reveal involvement in fraud, corruption, or other crimes that pose money-laundering risk.

- Record-keeping: Maintain detailed records of transactions, customer identification data, and the steps taken to comply with AML requirements. EU rules typically require keeping these records for at least five years. This includes copies of IDs, invoices, contracts, provenance documentation, and internal notes on risk assessments. Good record-keeping ensures transparency and is invaluable if investigators ever scrutinize a transaction.

- Reporting obligations: If a transaction or client activity looks suspicious or involves funds known or suspected to be criminal in origin, the business must file a Suspicious Activity Report (SAR) with the national Financial Intelligence Unit. This legal duty is akin to the reporting that banks do. Additionally, any cash transactions above certain thresholds (e.g. €10,000) should be reported when required. Prompt reporting shields the gallery/auction house from liability and aids law enforcement in tracking illicit networks.

To fulfill these obligations, art market participants should also appoint an AML compliance officer and train their staff on compliance procedures. Employees must be trained to spot red flags – such as a buyer refusing to provide information, insisting on paying in cash, or using an overly complex ownership structure for a purchase. Ultimately, a culture of compliance and ethical conduct is now an expected part of the art business. By conducting proper due diligence and documentation, galleries and auctioneers not only follow the law but also help protect the integrity of the art market.

Operational and Reputational Risks of Non-Compliance

Failing to comply with AML laws can be disastrous for an art business. The immediate risk is legal: authorities can impose hefty fines, revoke licenses, and even pursue criminal charges if a gallery or auction house is found complicit (even unwittingly) in money laundering. Under EU rules, those involved in laundering schemes can face prison sentences – 6AMLD mandates stricter penalties, including possible minimum prison terms for serious offenses. In some jurisdictions, individuals have been sentenced to years in jail for art-related money laundering conspiracies. Regulators are actively enforcing the new rules; for example, in the UK more than 30 art businesses were fined within two years of the 2020 law for failing to register or comply with AML requirements. The message is clear: non-compliance is not treated lightly.

Beyond fines and legal sanctions, consider the reputational damage that comes with an AML scandal. The art world operates on trust and reputation. If a gallery becomes known as a hub for shady transactions, it risks losing the confidence of legitimate clients, banks, and partners. Reputation loss can lead to a swift downturn in business – collectors will shy away, fearful of being tainted by association. As experts note, rebuilding trust after such damage can take years. Moreover, employees may quit and talent may be harder to attract if the company’s name is sullied. In short, the cost of non-compliance far outweighs the investment needed to build a solid AML program. By contrast, those who comply demonstrate integrity and due care, which can become a competitive advantage in an increasingly transparency-conscious market.

Automation: Supporting Safe and Transparent Transactions

Keeping up with AML compliance can seem daunting, especially for smaller galleries and auction houses with limited staff. This is where automation and technology-driven solutions make a difference. By digitizing and streamlining compliance workflows, art businesses can meet regulatory requirements efficiently and accurately. In fact, regulators and industry groups encourage the use of technology to strengthen AML controls in the art trade. Here’s how automation supports compliance:

- Digital client onboarding: Instead of relying on paper forms and manual ID checks, galleries can use secure online platforms to onboard clients. Clients can submit identification documents electronically, which can be verified instantly using AI-powered tools or databases. This not only speeds up the process but also catches fake IDs or inconsistencies more reliably. A digital audit trail is created for each customer, showing exactly when and how their identity was verified – useful evidence of compliance.

- Automated screening and due diligence: Compliance software can automatically screen new clients against sanctions lists, PEP lists, and watchlists in real time. It can also pull in adverse media results on a client with a click. By automating these database checks, art businesses ensure no client is overlooked and that risk-relevant information (like a buyer’s political exposure or a negative news article) is surfaced immediately. Sophisticated platforms even assign a risk score to clients based on factors like country of origin, transaction size, and profile, guiding the business on when to apply enhanced due diligence.

- Transaction monitoring systems: For auction houses managing numerous sales, software can monitor transactions and flag patterns that might indicate money laundering. For example, splitting a large payment into smaller ones, or rapid resales of a high-value piece, would trigger alerts. Rules can be set to catch anomalies (e.g. a purchase far above the estimated value, or a client buying art inconsistent with their known wealth profile). Automated alerts allow compliance officers to investigate timely. This kind of continuous monitoring is difficult to achieve manually, but machines excel at scanning data for irregularities 24/7.

- Secure record-keeping: An AML software solution provides centralized record-keeping where all client due diligence files, risk assessments, and transaction records are stored securely. Instead of shuffling through filing cabinets, compliance staff can retrieve any record in seconds. Built-in retention schedules ensure you keep data as long as legally required. In the event of an audit or inspection, having well-organized digital records dramatically reduces the effort to demonstrate compliance. It also helps in maintaining consistency – for instance, ensuring every high-value sale has an ID on file and a recorded source of funds check.

By leveraging automation in these ways, galleries and auctioneers can turn a compliance burden into a business strength. Technology reduces human error and frees up staff time, allowing compliance officers to focus on analyzing truly suspicious cases rather than getting bogged down in paperwork. It also gives owners peace of mind that nothing will “slip through the cracks” – the system will flag missing information or unusual behavior automatically. In an industry where regulations are evolving, an automated solution can be updated to keep pace with new rules, ensuring continuous compliance without constant retraining.

AMLTrack – AML automation tailored for the art market

AMLTrack is a compliance platform developed by TTMS in partnership with the law firm Sawaryn & Partners, designed to automate key anti-money laundering processes for obliged entities, including galleries and auction houses. The system streamlines client due diligence by verifying identities, checking customers against international sanctions and PEP lists, and retrieving data from official registers (such as KRS, CEIDG, and CRBR in Poland). It also supports risk assessment, generates compliance reports, and securely archives all actions to ensure full audit readiness. By minimizing human error and reducing the burden of manual checks, AMLTrack enables art market participants to meet EU AML requirements more efficiently, safeguard their reputation, and protect their businesses from regulatory penalties.

Ultimately, embracing digital AML tools helps art businesses fulfill the dual mandate of safety and transparency. It reassures clients that your gallery or auction house is a reputable, law-abiding place to do business, while making it far harder for criminals to exploit your platform. As the EU’s AML directives have shown, the era of art market opacity is ending. Galleries and auction houses that invest in compliance – and smart automation – are not only avoiding penalties, they are protecting their reputation and contributing to a cleaner, more transparent art market for all.

Do all galleries and auction houses in the EU need to comply with AML regulations?

Yes. Under the EU’s 5th Anti-Money Laundering Directive (5AMLD), all galleries, auction houses, and art dealers involved in transactions exceeding €10,000 must implement comprehensive AML procedures. This requirement applies to individual sales as well as multiple linked transactions totaling that amount or more.

What specific AML obligations do art market businesses have under EU law?

Art businesses must carry out client due diligence (CDD), verify the identity of buyers and beneficial owners, screen clients against sanctions and politically exposed persons (PEP) lists, monitor transactions for suspicious activity, maintain detailed records, and report suspicious transactions to financial authorities.

What makes the art market particularly attractive for money laundering?

The art market offers a combination of high-value assets, portability, privacy, and subjective valuation—ideal conditions for concealing and transferring illicit funds. Historically limited regulatory oversight and opaque transactions have further attracted criminals looking to legitimize illegal wealth.

Can AML automation really help smaller galleries comply with EU regulations?

Yes. Automation significantly simplifies compliance processes for galleries and auction houses of all sizes. Digital tools streamline client onboarding, automate identity checks, continuously monitor transactions, and ensure robust record-keeping, helping even small businesses meet complex regulatory requirements without needing extensive compliance teams.

What happens if an art gallery or auction house does not comply with AML regulations?

Non-compliance with AML rules can result in severe financial penalties, legal sanctions, and potentially criminal charges under EU laws like 6AMLD. Beyond legal consequences, businesses risk serious reputational damage, loss of client trust, reduced market opportunities, and difficulties restoring their standing within the art community.