In 2017, investigators uncovered that a notorious drug cartel had established entire networks of car dealerships solely to launder illicit cash. And in another case, a seemingly ordinary car dealer in the UK was prosecuted and forced to forfeit over £1 million in assets after unwittingly washing criminal money through his showroom. These real-world examples underscore a stark reality: if your business frequently handles large cash transactions – whether you run a car dealership, jewelry store, luxury boutique, construction firm, or hotel – you could be targeted as a conduit for money laundering. Governments are well aware of this risk, which is why cash-intensive businesses face stringent Anti-Money Laundering (AML) compliance requirements today.

Europe’s AML Rules and the €10,000 Cash Threshold (5AMLD)

A key provision in European AML regulations, particularly the EU’s Fifth Anti-Money Laundering Directive (5AMLD), is the legal obligation to monitor and report large cash payments. Under EU law, any person or business trading in goods that receives a payment in cash over €10,000 must comply with AML directives. In practice, this means performing customer identity checks and diligence on big cash deals, and often reporting transactions above that €10k threshold to the authorities. The 5AMLD, implemented in 2020, expanded the scope of regulated entities to include more high-value dealers – even art and luxury goods merchants – whenever a transaction (or series of linked transactions) is €10,000 or more. In short, if someone walks into your showroom with a bag of cash, you have a legal duty to verify who they are, understand the source of those funds, and keep an eye out for anything suspicious.

Why Cash-Intensive Businesses Are High-Risk for Money Laundering

Cash remains the criminal’s favorite tool for a reason: it’s anonymous and hard to trace. When a luxury car or expensive diamond can be bought outright with cash, it allows criminals to legitimize huge sums of dirty money in a single transaction. Cash-heavy sectors also historically had less regulatory scrutiny than banks, making them softer targets for illicit activity. In fact, many dealers and staff in these industries have low awareness of AML rules – studies show high-value dealers seldom file reports even when they suspect something is off. All these factors combine to elevate the money laundering risk. Regulators classify cash-intensive businesses as “high-risk” because criminals can exploit them to insert illicit funds into the legitimate financial system with relative ease.

Key AML Obligations for Cash-Intensive Businesses

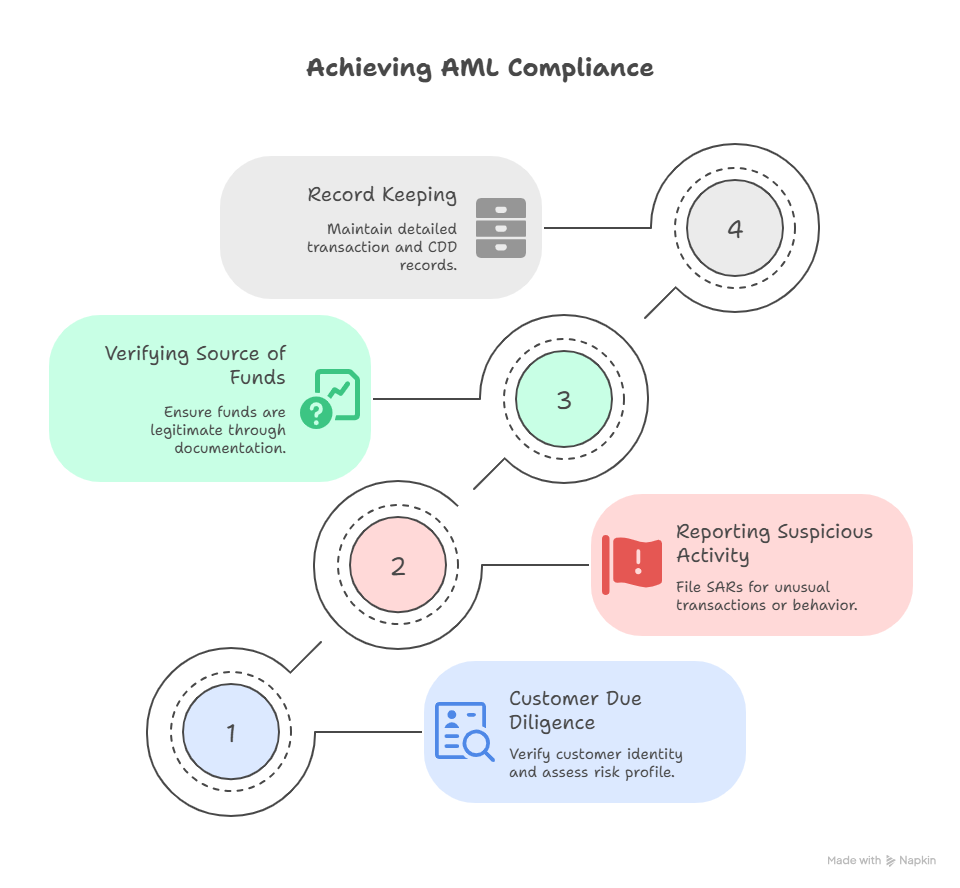

So what exactly must a car dealer, jeweler, or other cash-intensive business do to stay compliant? EU directives and national laws impose several core AML obligations on these businesses (often called “obliged entities” under the law) when dealing with large cash payments:

- Customer Due Diligence (CDD): You must verify your customer’s identity and, where applicable, the beneficial owner behind a purchase. This means collecting official ID documents (passports, driver’s licenses, etc.) and confirming the person is who they claim to be before completing a high-value sale. CDD also involves assessing the customer’s risk profile (Are they a politically exposed person? Do they reside in a high-risk country?).

- Reporting Suspicious Activity: If something about a transaction or customer behavior raises red flags, you are legally obliged to file a Suspicious Activity Report (SAR) with your country’s financial intelligence unit. Examples might include a buyer trying to pay just under €10,000 in multiple installments, or someone evading questions about where their money comes from. Prompt reporting shields your business from liability and helps authorities stop criminal funds.

- Verifying Source of Funds: For large or unusual transactions, you should dig deeper into where the customer’s money is coming from. AML rules call this “Enhanced Due Diligence.” It can involve requesting documentation proving the source of the funds or wealth (for instance, bank statements or proof of earnings). If a client walks in with €50,000 in cash, you need reasonable assurance that the cash wasn’t generated by crime.

- Record Keeping: Businesses must keep thorough records of all transactions above the threshold and copies of all CDD information (IDs, forms, address proofs, etc.) for at least five years. This paper trail (increasingly digital) should document what checks you did and will be vital if regulators come knocking or during an audit. Proper recordkeeping also means you can readily retrieve details if a suspicious transaction is investigated even years later.

Challenges in Meeting AML Compliance

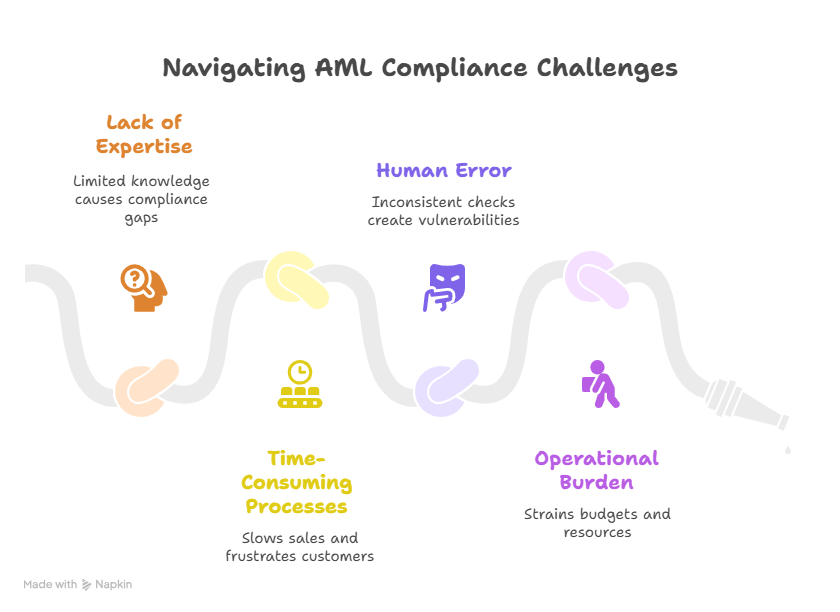

Adhering to these rules can be challenging for cash-intensive businesses, many of which are small to mid-sized firms without dedicated compliance departments. Some common hurdles include:

- Lack of Expertise & Training: The intricacies of AML law – from identifying politically exposed persons to recognizing complex money-laundering red flags – are not simple. Business owners and staff often aren’t AML experts, and keeping up with regulatory changes requires ongoing training. Mistakes or oversight due to limited knowledge can lead to compliance gaps.

- Time-Consuming Processes: Conducting manual ID checks, filling out forms, and logging transaction details can significantly slow down a sale. For example, verifying a customer’s identity and recording their information might delay a big-ticket purchase, frustrating customers and staff alike. Compliance paperwork and due diligence take time, which is at odds with fast-paced sales environments.

- Human Error and Inconsistency: Relying on purely manual compliance measures means there’s always a risk of something slipping through the cracks. An overwhelmed employee might miss that two €9,500 cash payments (just under the limit) were made by the same person within a short period. Inconsistent application of checks – like one salesperson photocopying IDs diligently while another forgets – can leave vulnerabilities that criminals exploit.

- Operational and Cost Burden: Implementing AML controls isn’t free. High-value dealers may need to register with regulators and invest in systems or external advice to meet their obligations. For a small business, dedicating resources to compliance (hiring compliance officers, storing documents securely, conducting background screenings) can strain budgets. Many firms feel caught between needing to comply and not having enterprise-level infrastructure to do so efficiently.

How Automation Simplifies AML Compliance

Fortunately, technology is transforming the way businesses approach AML compliance. Automation and digital tools (often called “RegTech” in the compliance world) can dramatically reduce the burden of meeting AML obligations. Here’s how leveraging automation can help cash-intensive businesses stay on the right side of the law while saving time and effort:

- Digital KYC (Know Your Customer): Instead of copying passports and manually checking documents, businesses can use digital KYC solutions to verify customer identities in minutes. Automated platforms can scan IDs, validate their authenticity, and cross-check customers against databases of sanctioned individuals or politically exposed persons – all in real time. This means every customer undergoes the required CDD without bogging down your sales process.

- Automated Transaction Flagging: AML software can automatically monitor and flag transactions that meet risk criteria. For example, if a cash payment exceeds €10,000, the system can instantly alert management and prompt the required reporting. More subtly, if multiple smaller payments appear structured to avoid detection, an automated system can detect the pattern and raise an alarm. By catching these signals early, automation ensures suspicious activities don’t go unnoticed.

- Integrated Monitoring Systems: With an integrated compliance platform, all your AML efforts – customer verification, transaction logs, risk scoring, and reporting – work in concert. Such systems provide a centralized dashboard where you can see the full picture of a customer’s activity and risk level at a glance. This holistic view makes it far easier to identify red flags that might be missed when information is scattered. It also simplifies compliance audits, since all data and checks are recorded in one place and can be easily compiled into required reports.

- Secure Recordkeeping: Automation helps maintain an organized, secure audit trail of all your AML activities. Customer IDs, due diligence documents, and transaction records can be stored digitally with encryption and backed up, eliminating the worry of lost papers or spilled coffee on a logbook. When regulators ask for evidence of compliance (say, proof of a client’s ID and transaction details from three years ago), you can retrieve it with a quick search instead of sifting through file cabinets. Proper record retention happens automatically, keeping you prepared for any inspections.

AMLTrack – Intelligent AML Compliance for Cash-Intensive Businesses

AMLTrack is an AI-powered compliance platform that automates every step of the anti-money laundering process for cash-intensive businesses – from instant digital customer verification to continuous transaction monitoring. Integrated with international sanctions lists and PEP databases, AMLTrack verifies customers in seconds and applies consistent risk scoring to every transaction. Real-time monitoring flags large cash payments, suspicious patterns (like multiple sub-threshold transactions), and other red flags unique to high-value goods and services. All compliance actions are logged in a secure, audit-ready environment, enabling quick retrieval of records for regulators or internal reviews. AMLTrack’s centralized dashboard gives business owners a complete view of customer activity and risk, while automated reporting ensures deadlines are met without manual paperwork. Scalable and cloud-ready, AMLTrack reduces compliance costs, speeds up sales processes, and strengthens defenses against criminal misuse of cash transactions.

By embracing automated AML solutions, cash-intensive businesses can turn compliance from a headache into a streamlined routine. The result is not only reduced risk of fines or legal trouble, but also peace of mind – owners can focus on running and growing their business, knowing that robust controls are silently working in the background to keep criminal money out.

Why are businesses accepting large cash payments considered high-risk for money laundering?

Cash transactions are attractive to criminals because they’re anonymous and difficult to trace, making them ideal for introducing illicit funds into the legitimate economy. Businesses that frequently handle large cash amounts—like car dealerships, jewelry stores, or luxury retailers—are especially vulnerable since high-value goods can easily convert criminal money into legitimate assets. Regulators closely monitor these sectors precisely because criminals have historically exploited their transactions to conceal or legitimize illicit gains.

What exactly must my business do when accepting cash payments above €10,000 in the EU?

Under EU law (particularly the 5th Anti-Money Laundering Directive or 5AMLD), if your business accepts a cash payment of €10,000 or more, you’re required to perform customer due diligence (CDD). This involves verifying your customer’s identity, collecting identification documents, and understanding the source of the cash. You must also keep detailed records of these transactions for at least five years and promptly report any suspicious activity to your local financial intelligence authority.

How can automation simplify AML compliance for my business?

AML automation helps by digitizing and streamlining the entire compliance process, saving your business significant time and effort. Automated solutions handle identity verification electronically, instantly checking customers against sanction lists or PEP databases, significantly reducing manual workloads. They also continuously monitor transactions, automatically flagging unusual patterns or cash payments exceeding regulatory thresholds, ensuring you’re immediately aware of potential red flags without manual oversight. This proactive approach reduces errors and ensures consistent compliance across your operations.

What are the consequences of failing to comply with AML regulations for cash-intensive businesses?

The penalties for non-compliance can be severe, including substantial fines, regulatory investigations, and even criminal charges in cases of serious negligence or intentional wrongdoing. Beyond the direct financial penalties, businesses face considerable reputational damage if associated publicly with money laundering or financial crime. Loss of customer trust and potential exclusion from the market can follow, causing long-term harm to your business reputation and profitability.

Do small businesses accepting cash also need to worry about AML compliance, or is it mainly for larger companies?

AML regulations apply equally to businesses of all sizes whenever transactions reach or exceed the €10,000 threshold. Even small businesses are legally required to implement adequate AML procedures such as verifying customer identities, conducting risk assessments, and reporting suspicious transactions. While larger businesses may have more extensive compliance resources, smaller firms can benefit greatly from automated AML tools, simplifying the process, reducing the compliance burden, and protecting them from potential legal and regulatory repercussions.