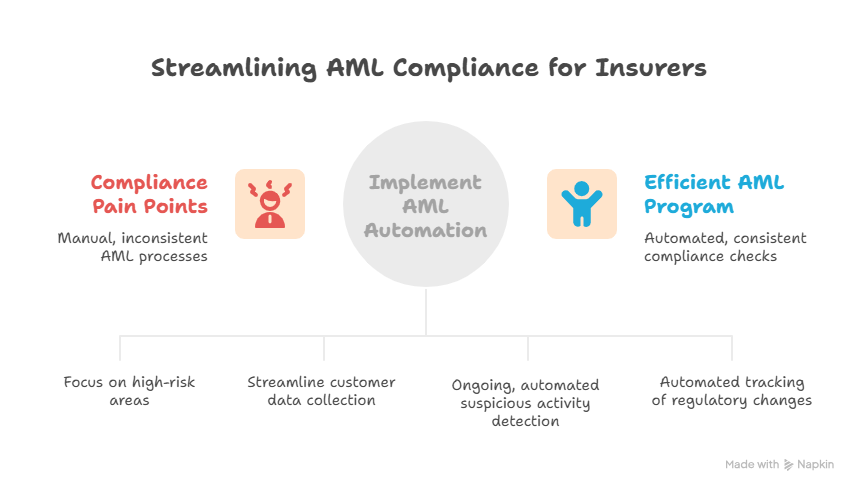

Anti-money laundering (AML) compliance is a resource-intensive function for insurance companies in the European Union. Insurers face strict AML obligations, and meeting these requirements with manual processes creates a heavy compliance burden and leaves them exposed to operational and compliance risks. By embracing AML automation, insurers can reduce this burden and mitigate risk while remaining fully compliant with EU requirements.

EU Regulatory Obligations and Compliance Pain Points for Insurers

In the EU, insurance companies are obliged entities under anti-money laundering laws and must implement robust AML programs. EU directives mandate a risk-based approach – applying stricter controls to higher-risk customers, products, and transactions. Key obligations include thorough customer due diligence (CDD) on policyholders and beneficiaries, ongoing transaction monitoring, screening for politically exposed persons (PEPs) and sanctioned parties, and prompt suspicious activity reporting to Financial Intelligence Units. Supervisory authorities also expect insurers to maintain strong governance and internal controls to keep these measures effective and up to date.

All these requirements create significant compliance pain points for insurers. Companies often manage high volumes of policies through intermediaries, which complicates customer data collection and monitoring. Manual KYC and due diligence processes spread across different teams can result in inconsistent checks or oversight gaps. Keeping pace with frequent regulatory changes is extremely difficult without automation, making any spreadsheet-reliant approach increasingly unsustainable.

Operational and Legal Risks of Manual Compliance Processes

Operational Inefficiencies

Manual AML compliance processes in insurance are labor-intensive. Performing KYC checks, monitoring transactions, and compiling reports by hand delays onboarding of new policyholders and strains internal resources. Subjective human judgment can lead to uneven risk classification – one analyst’s “high-risk” customer might be labeled “medium-risk” by another. Siloed data and lack of integration between internal systems mean red flags can be overlooked or duplicated. These inefficiencies translate to higher costs and a poorer customer experience (clients waiting weeks for policy approval due to prolonged compliance checks).

Compliance Failures and Penalties

Relying on manual, ad-hoc workflows for AML heightens the risk of serious compliance failures. Human error or omission might result in a suspicious transaction going unreported or a high-risk customer not receiving enhanced due diligence. Such lapses carry severe consequences: regulators can impose heavy fines (up to 10% of annual turnover) or even suspend an insurer’s license, leading to reputational damage. Additionally, senior managers can be held personally liable for major AML failures. A manual approach therefore leaves insurers dangerously exposed to compliance risk.

Benefits of AML Automation for Insurers

Using modern compliance technology like AI-driven risk engines and integrated watchlist screening, insurers can turn AML from a tedious checkbox exercise into a proactive risk management advantage. The main advantages of AML automation for insurers include:

Faster Customer Onboarding

AML automation significantly speeds up customer acquisition and policy issuance. Digital identity verification and document checks can be completed within minutes instead of days, allowing new policyholders to be onboarded with minimal friction. Rather than manual data entry, automated workflows use reliable databases to verify identities in seconds. This acceleration means customers get insured faster, and brokers or agents can close policies without long compliance delays.

Consistent Risk Scoring and Monitoring

An automated AML system applies uniform risk assessment criteria across all customers and transactions, eliminating the inconsistencies of manual reviews. Every policyholder is screened against the same up-to-date watchlists and risk indicators, producing standardized risk ratings that trigger appropriate due diligence steps. Ongoing monitoring runs continuously in the background, flagging suspicious patterns (such as unusually large premium top-ups or rapid policy surrenders) in real time. With centrally defined rules and models, management gains a consistent view of enterprise-wide risk exposure. This alignment with objective criteria also meets regulators’ expectations for effective AML controls.

Detection of Complex Fraud Schemes

Advanced analytics and machine learning in AML software help uncover sophisticated money laundering schemes. Criminals may exploit insurance products using tactics like purchasing multiple small policies or quickly canceling new policies to reclaim funds (abusing the “cooling-off” period). An automated platform can correlate data across policies and transactions to spot such red flags. For example, it might recognize a pattern of rapid cancellations and refunds that signals systematic abuse. Automated detection greatly improves an insurer’s ability to intercept illicit activity and protect the business from financial crime.

Audit Readiness and Transparency

Automation bolsters audit readiness and regulatory reporting. The system automatically logs every compliance action – from initial due diligence checks to the resolution of alerts – creating a detailed audit trail. Any time an auditor or regulator inquires about a case, the compliance team can instantly retrieve all records of checks and decisions. Automated solutions also produce timely compliance reports, giving management clear visibility into program performance. This transparency makes regulatory inspections smoother and assures stakeholders that AML controls are working effectively.

By embracing AML automation, insurers achieve faster and more consistent compliance operations. Staff once bogged down by manual reviews can focus on high-risk cases, while routine screening and monitoring are handled by technology. The result is a reduced compliance burden, lower costs, and a stronger defense against financial crime.

AMLTrack – Intelligent AML Compliance for the Insurance Sector

AMLTrack is an AI-powered compliance platform that automates the entire anti-money laundering process for insurers, from digital customer onboarding to continuous transaction monitoring. Designed in collaboration with legal and IT experts, AMLTrack integrates directly with sanctions lists (EU, UN, UK, US) and PEP databases, automatically verifying policyholders and beneficiaries in seconds. Built-in risk scoring models ensure consistent classification across all cases, while real-time monitoring flags unusual premium payments, rapid policy cancellations, or other red-flag patterns unique to insurance products. The system securely stores all compliance actions in an audit-ready environment, enabling instant retrieval of due diligence records for regulators or internal reviews. Fully scalable and cloud-ready, AMLTrack adapts to the size and complexity of any insurer’s operations, reducing compliance costs, accelerating policy issuance, and strengthening defenses against financial crime.

Are insurance companies really at risk of money laundering activities?

Yes. Although insurance may seem lower-risk than banking, certain life insurance and investment-linked products can be misused to hide or move illicit funds. Criminals may use overfunded policies, rapid surrenders, or third-party premium payments to obscure the origin of money. Regulators treat insurers as obliged entities under EU AML laws for precisely this reason.

What types of insurance products require the most AML attention?

Life insurance policies with savings components, unit-linked insurance products, and annuities typically carry the highest AML risk. These products can function like financial instruments, making them attractive for placement and layering of funds. Policies that allow early withdrawal, high-value premiums, or third-party payers should be subject to enhanced due diligence.

How do AML obligations differ for brokers or intermediaries?

Insurance brokers and agents are often the first point of contact with the customer, which means they play a key role in collecting KYC data. While the legal AML obligation remains with the insurer, regulators expect companies to implement systems that ensure brokers follow proper due diligence procedures. Automating these workflows helps insurers maintain oversight and consistency across all sales channels.

What’s the main advantage of AML automation for compliance teams?

The biggest advantage is efficiency and consistency. Automation reduces manual workloads, standardizes how risk assessments are applied, and ensures that alerts are not missed. This allows compliance officers to focus on investigating true risks rather than chasing paperwork or inconsistencies. It also helps meet tight regulatory timelines for reporting suspicious activities.

Can AML automation adapt to changes in EU regulations?

Yes, most modern AML platforms are built with compliance flexibility in mind. They are regularly updated to reflect changes in EU directives and local transpositions. This means that when a new rule comes into force (e.g. around digital onboarding or crypto exposure), the system can be reconfigured quickly — avoiding costly manual retraining or workflow redesign.